Overview

Trust score

Tradeable Symbols (Total): 965

Year Founded: 2009

Publicly Traded (Listed): No

Bank: No

Moneta Markets is not publicly traded, does not operate a bank, and is authorised by two tier-1 regulators (high trust), zero tier-2 regulators (average trust), and one tier-3 regulator (low trust). Moneta Markets is authorised by the following tier-1 regulators: Australian Securities & Investment Commission (ASIC) and the Financial Conduct Authority (FCA). Learn more about Trust Score.

Moneta Markets is considered average-risk, with an overall Trust Score of 71 out of 99.

Pros 👍🏻

- Moneta Markets has regulatory status in one tier-3 jurisdiction and is part of Vantage Group, which holds licenses in two tier-1 jurisdictions.

- Holds indemnity insurance to provide protection in addition to its regulatory coverage.

- DupliTrade is available for social copy-trading.

- Offers the MetaTrader suite alongside its own proprietary platforms WebTrader and AppTrader.

Cons 👎🏻

- Moneta Markets is not a good choice for low-cost trading.

- Some modules on Moneta Markets site were outdated, and some simply did not load.

- The WebTrader platform and related mobile AppTrader lack integrated trading tools.

- Offers a smaller range of markets than leading multi-asset brokers.

- Despite providing Trading Central add-ons and branded Moneta TV daily video content, Moneta Markets lacks comprehensive, quality market research.

- There are over 100 educational videos in the Moneta Markets Masters Course, but there is a distinct absence of in-depth written articles.

Offering of investments

The range of markets available will depend on which Moneta Markets entity and platform you use, with up to 266 symbols available across various CFD markets including forex, shares, indices, commodities, and metals.

Cryptocurrency: Cryptocurrency trading is available at Moneta Markets through CFDs, but not available through trading the underlying asset (e.g. buying Bitcoin). Note: Crypto CFDs are not available to retail traders from any broker’s U.K. entity, nor to U.K. residents.

The table below summarizes the different investment products available to Moneta Markets clients.

| Feature |  |

| Forex Trading (Spot or CFDs) | Yes |

| Tradeable Symbols (Total) | 965 |

| Forex Pairs (Total) | 54 |

| U.S. Stock Trading (Non CFD) | No |

| Int’l Stock Trading (Non CFD) | No |

| Social Trading / Copy Trading | Yes |

| Cryptocurrency (Physical) | No |

| Cryptocurrency (CFD) | Yes |

| Disclaimers | Note: Crypto CFDs are not available to retail traders from any broker’s U.K. entity, nor to U.K. residents (except to Professional clients). |

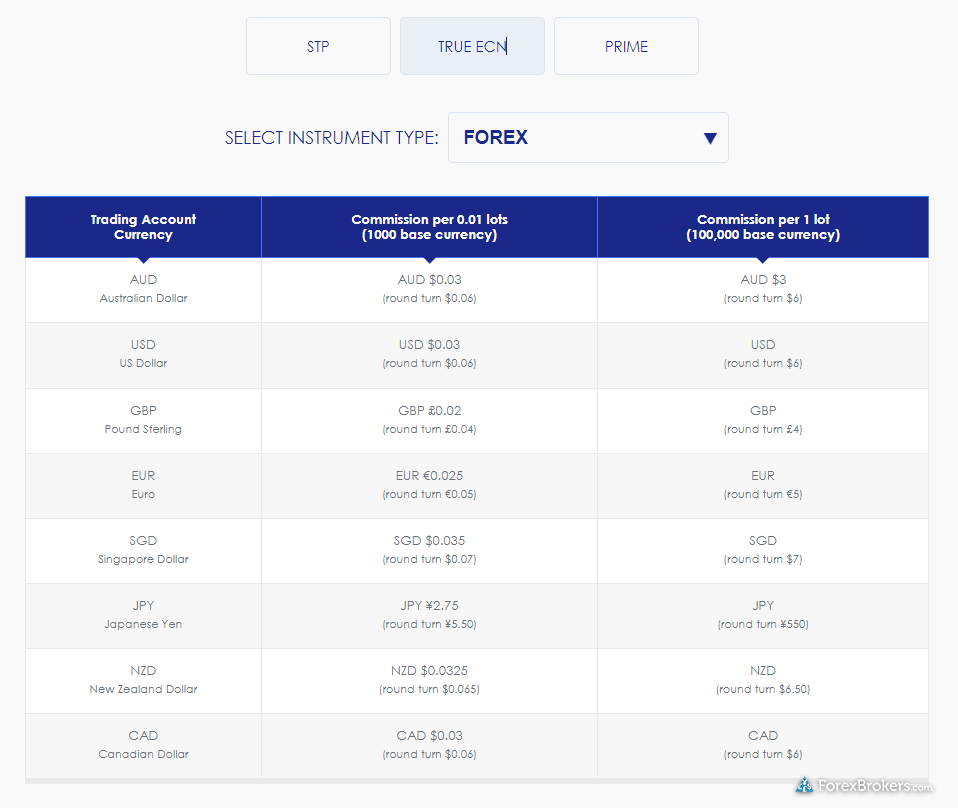

Commissions and fees

Trading costs at Moneta Markets vary depending on which of its three account options you choose: the commission-based STP and Moneta Prime accounts, or the commission-free True ECN account. Moneta Markets’ STP account is an expensive option for forex trading, while pricing for its True ECN account is closer to the industry average with tighter spreads and a commission of $6 per round-turn lot. Overall, Moneta Markets’ pricing can’t compete with the best forex brokers.

Spread-only accounts: The STP account boasts an average spread of 1.22 pips for the EUR/USD pair for the month of August 2021.

Commission-based accounts: The True ECN account features an average spread of 0.15 pips for the EUR/USD pair (during August 2021), and a commission of $3 per side for every 100,000 units (or $6 per round-trip standard lot). This brings the all-in cost for the True ECN account to roughly 0.75 pips, which is slightly below the industry average.

| Feature |  |

| Minimum Initial Deposit | $50 |

| Average Spread EUR/USD – Standard | 1.27 (September 2022) |

| All-in Cost EUR/USD – Active | 0.77 (September 2022) |

| Active Trader or VIP Discounts | No |

| Execution: Agency Broker | No |

| Execution: Market Maker | Yes |

Mobile trading apps

Moneta Markets offers the MetaTrader suite of platforms (from the brand’s parent company), as well as its own simple AppTrader mobile app. Moneta Markets’ AppTrader mobile app remains very basic, and MetaTrader comes with no extra add-ons beyond the default platform suite, making Moneta Markets a laggard compared to the best MetaTrader brokers.

Apps overview: Moneta Markets provides its own AppTrader platform as well as the full MetaTrader mobile platform suite (MT4 and MT5), all available on Google Play for Android and on Apple’s App Store for iOS devices.

AppTrader is developed by PandaTS, the same developer that helps power the Moneta Markets web platform, while MetaTrader is developed by MetaQuotes Software Corporation.

Ease of use: Though AppTrader is easy to use, there just isn’t much going on in the app and there remains plenty of room for improvement. I’d like to see Moneta Markets mirror some of the web platform’s features on its AppTrader mobile app to more closely unify the experience across devices.

Charting: Charts within AppTrader appear to resemble those available in the web version, except with no indicators and no drawing tools. Also, charts cannot rotate into landscape mode, and watchlists do not sync with the web version. For comparison, Saxo Bank and TD Ameritrade (U.S. citizens only) are examples of brokers that have nearly perfected the art of creating a synced experience across devices (even trend lines are synced across platforms).

| Feature |  |

| Android App | Yes |

| Apple iOS App | Yes |

| Mobile Alerts – Basic Fields | Yes |

| Watchlists – Total Fields | 4 |

| Watchlist Syncing | No |

| Charting – Indicators / Studies (Total) | 102 |

| Charting – Drawing Tools (Total) | 78 |

Other trading platforms

Moneta Market’s WebTrader platform has a clean layout, but a shallow selection of features. For example, there are no news headlines available, and only four watchlist columns.

Platforms overview: Moneta Markets offers you two choices of trading platforms: the MetaTrader platform suite (MT4 and MT5) developed by MetaQuotes Software Corporation, and the PandaTS-powered Moneta Markets WebTrader app.

Charting: Charts at Moneta Markets are just OK, providing six types, ten drawing tools, 48 indicators, and nine timeframes. The panning and zooming were less smooth than I expected but not terrible, such as when using the dedicated zoom buttons. Brokers like FOREX.com and eToro provide a more comprehensive charting package.

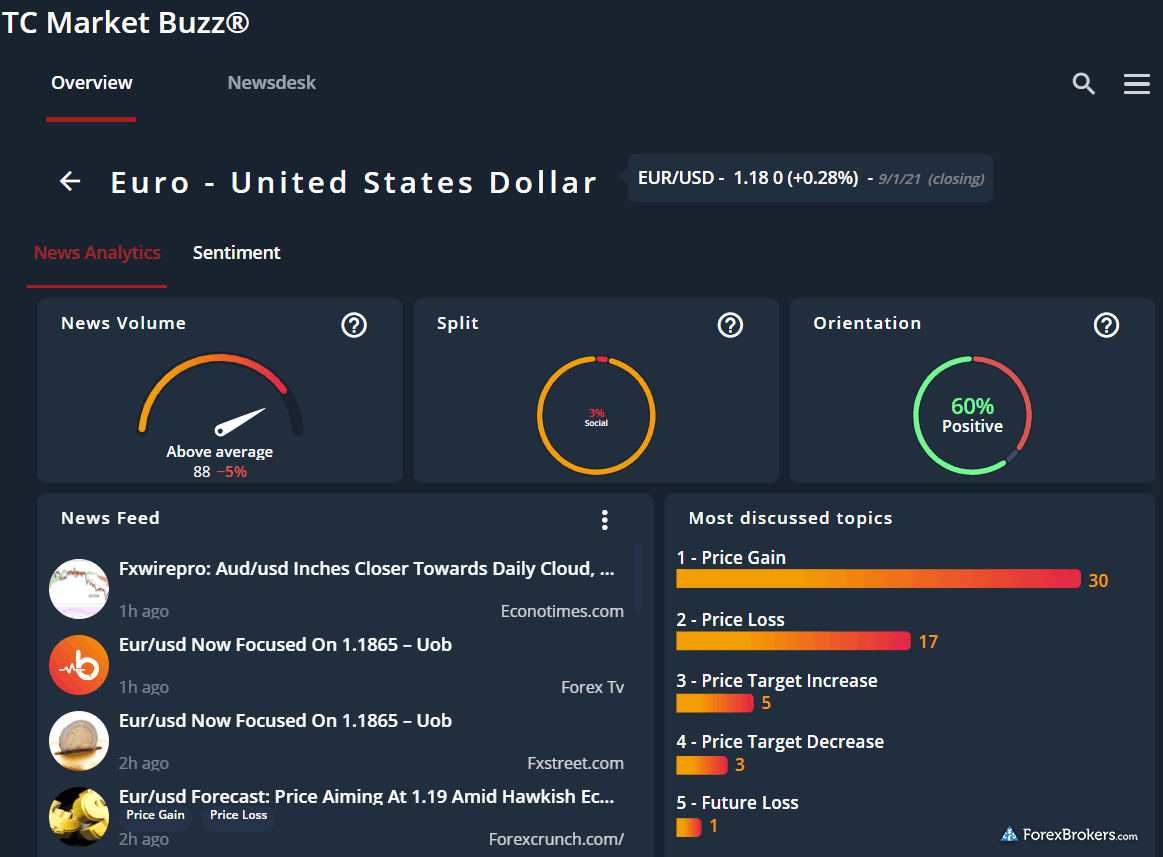

Trading tools: WebTrader offers just a handful of tools, such as Trading Central’s Market Buzz, Featured Ideas, and Economic Calendar. However, these features are not integrated within the platform, and simply redirect to open in a new tab from external link. Fully integrating these tools within the platform is a crucial long-term fix, as it would provide a measurably smoother WebTrader experience, and would allow traders to stay focused on the markets.

Platform usability: The first thing I noticed on the WebTrader platform is the smooth HTML5 that is now the industry standard for web-based trading apps. The platform is also incredibly easy to navigate. While beginners may find the WebTrader platform suitable for their needs, more demanding traders will not. For example, complex order types such as a trailing stop-loss are simply not available on WebTrader.

Sentiment data: The Trader’s Trend section below the order ticket displays sentiment data, but lacks detail beyond a simple percentage ratio of bears to bulls. For comparison, CMC Markets also zooms in on details like the sentiment of its most successful traders, with corresponding daily percentage change information.

| Feature |  |

| Virtual Trading (Demo) | Yes |

| Proprietary Platform | No |

| Desktop Platform (Windows) | Yes |

| Web Platform | Yes |

| Social Trading / Copy Trading | Yes |

| MetaTrader 4 (MT4) | Yes |

| MetaTrader 5 (MT5) | Yes |

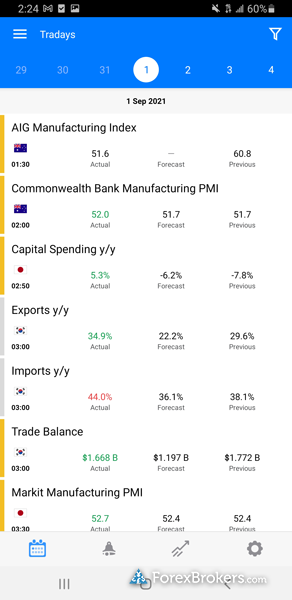

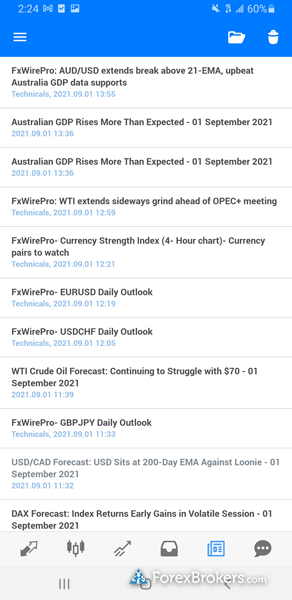

Market research

Moneta Markets provides access to good third-party content from Trading Central, but does not otherwise provide much in the way of in-house research, and therefore trails the industry average in this category, far behind research leaders Saxo Bank and IG.

Research overview: Moneta Markets hosts videos from its Moneta TV series, but otherwise its research content is sourced almost entirely from third-party sources – such as the suite of research tools from Trading Central and streaming headlines from FxWirePro – with little-to-no in-house content.

Market news and analysis: Daily market briefings are available on the broker’s YouTube channel under the Moneta TV series powered by Trading Central. Both video series follow a consistent daily template with a high-level overview of key market movements. Though a bit plain, the videos are quick snippets that I found to be useful and easy to digest. I would like to see these videos integrated into the platform, which would make them easier for traders to consume.

Trading Central: Moneta Markets provides access to several third-party research tools from Trading Central, such as Market Buzz, Featured Ideas, and the Economic Calendar. To access these tools, however, clients will need to maintain an account balance of at least $500. For comparison, some of the best forex brokers offer such content and premium tools for all live account holders. Furthermore, these tools are not directly integrated into the trading platform.

| Feature |  |

| Daily Market Commentary | Yes |

| Forex News (Top-Tier Sources) | Yes |

| Autochartist | No |

| Trading Central (Recognia) | Yes |

| Social Sentiment – Currency Pairs | Yes |

Education

Moneta Markets’ educational content doesn’t offer much beyond the videos available in its Masters Course. The Masters Course covers multiple asset classes, and deftly explores a variety of topics and categories with brief video clips for beginners, and longer videos for more advanced concepts.

Learning center: The Moneta Markets Masters Course features a total of 114 videos that range from just a few minutes to about ten minutes long, many of which I found to be useful.

Room for improvement: I’d like to see Moneta Markets add more content (such as webinars) to its YouTube channel. It would also benefit from an expansion of its published written content, which would help to fill the gap in its educational offering.

| Feature |  |

| Has Education – Forex or CFDs | Yes |

| Client Webinars | No |

| Client Webinars (Archived) | No |

| Videos – Beginner Trading Videos | Yes |

| Videos – Advanced Trading Videos | Yes |

| Investor Dictionary (Glossary) | No |

Final thoughts

Moneta Markets is a Cayman Islands-regulated broker that is backed by its larger parent company Vantage Group, which is a trusted broker regulated in tier-1 jurisdictions.

Testing Moneta Markets left me with a clear takeaway; to compete with the best forex brokers, it needs to enhance its offering in multiple categories. Moneta Markets currently trails the industry average in its research and educational content, and lags behind the best forex brokers in key categories such as trading costs and the availability of mobile trading apps and platforms.

About Moneta Markets

Moneta Markets is a brand of Vantage International Group Limited. Moneta Markets holds its client’s funds at National Australia Bank (NAB), as part of its Cayman Islands offering regulated by the Cayman Islands Monetary Authority (CIMA). The brand also holds a license with the Vanuatu Financial Services Commission (VFSC). Moneta Markets was founded in 2019 and is part of the Vantage Group of companies. With entities that hold regulatory statuses in Australia and the United Kingdom, the group has a history since 2009 (see our Vantage review for more).

2022 Review Methodology

For our 2022 Forex Broker Review we assessed, rated, and ranked 39 international forex brokers over a three-month time period resulting in over 50,000 words of published research.

Each broker was graded on 113 different variables, including our proprietary Trust Score algorithm. This innovative scoring system ranks the level of trustworthiness for each broker based on factors such as licenses, regulation and corporate structure. Read about Trust Score here.

As part of our annual review process, all brokers had the opportunity to provide updates and key milestones and complete an in-depth data profile, which we hand-checked for accuracy.

Ultimately, our rigorous data validation process yields an error rate of less than .1% each year, providing site visitors with quality data they can trust. Learn more about how we test.

Forex Risk Disclaimer

There is a very high degree of risk involved in trading securities. With respect to margin-based foreign exchange trading, off-exchange derivatives, and cryptocurrencies, there is considerable exposure to risk, including but not limited to, leverage, creditworthiness, limited regulatory protection and market volatility that may substantially affect the price, or liquidity of a currency or related instrument. It should not be assumed that the methods, techniques, or indicators presented in these products will be profitable, or that they will not result in losses. Read more on forex trading risks.

Reviews

There are no reviews yet.