Overview

Trust score

Tradeable Symbols (Total): 8425

Year Founded: 2001

Publicly Traded (Listed): No

Bank: No

Admiral Markets is considered average-risk, with an overall Trust Score of 87 out of 99. Admiral Markets is not publicly traded, does not operate a bank, and is authorised by two tier-1 regulators (high trust), two tier-2 regulators (average trust), and zero tier-3 regulators (low trust). Admiral Markets is authorised by the following tier-1 regulators: Australian Securities & Investment Commission (ASIC) and the Financial Conduct Authority (FCA). Learn more about Trust Score.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 81% of retail CFD accounts lose money You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Traders choose Admiral Markets (Admirals) for its excellent investor education and advanced MetaTrader features — such as the Supreme add-ons — alongside an extensive range of shares, forex and CFD markets, and premium research content.

Pros 👍🏻

- Admiral Markets stands out among the crowded field of MetaTrader-only brokers who offer few — if any — supplemental platform features.

- Offers StereoTrader dashboard for MetaTrader and Supreme suite of custom indicators.

- Premium Analytics features Dow Jones News, sentiment analysis from Acuity Trading, and Trading Central signals.

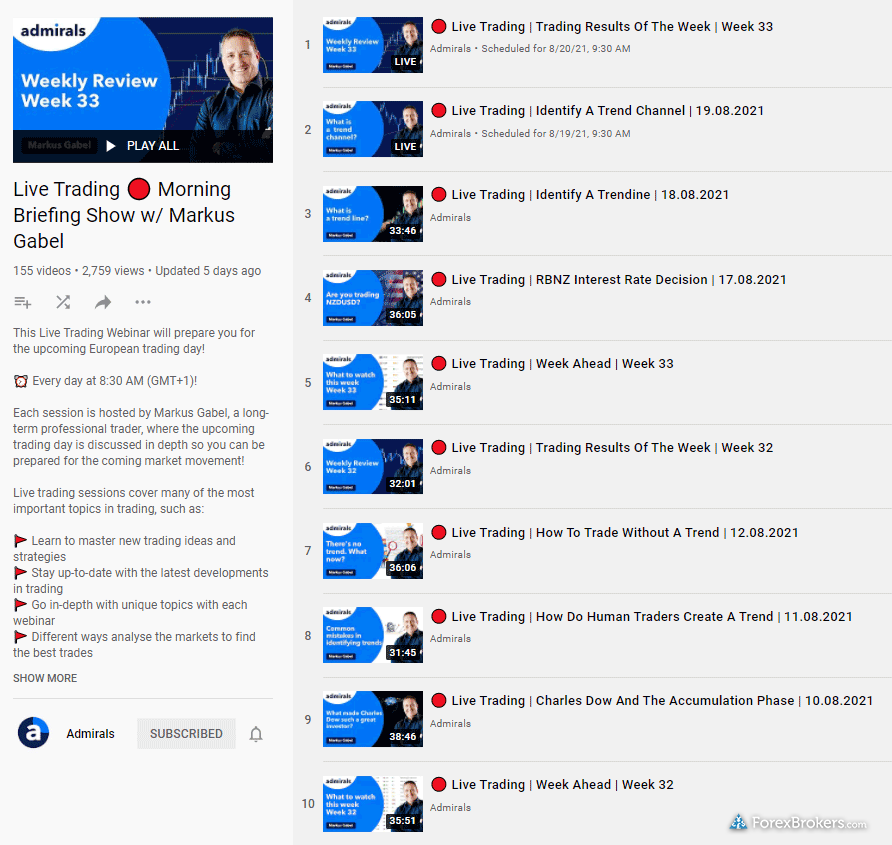

- Outstanding educational content — Admiral Markets is a top contender in this category in 2022.

- Regulated in Australia by ASIC, Cyprus by CySEC, the U.K. (by FCA), and Jordan (by JSC).

- 340 Admiral Markets staff serve over 48,000 clients, with more than $82 million in clients assets.

- Offers 8,425 tradeable symbols: 3,827 CFDs and 4,598 exchange-traded securities (non-CFD).

- Provides a unique set of volatility protection tools for managing risk.

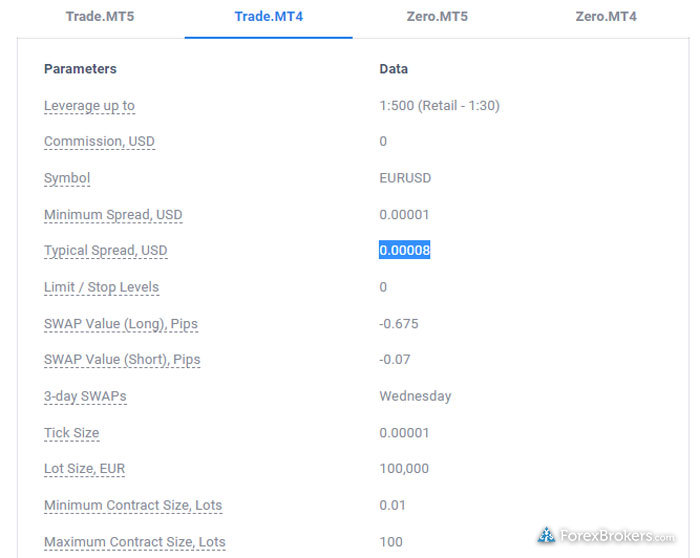

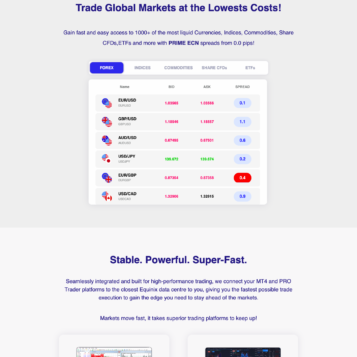

- Competitive pricing for EUR/USD; the all-in cost for its commission-based account is 0.7 pips (after $6 fee).

Cons 👎🏻

- Admiral Prime account for MT5 offers a significantly narrower range of tradeable symbols.

- Admiral Markets AS is the sole liquidity provider (market-maker) for all its group companies.

- Spreads on the commission-free Trade account are in-line with the industry average of 0.8 pips for EUR/USD (based on July 2021 data).

- Maximum contract size limited to 100 lots on MT5 accounts — compared to 200 on MT4.

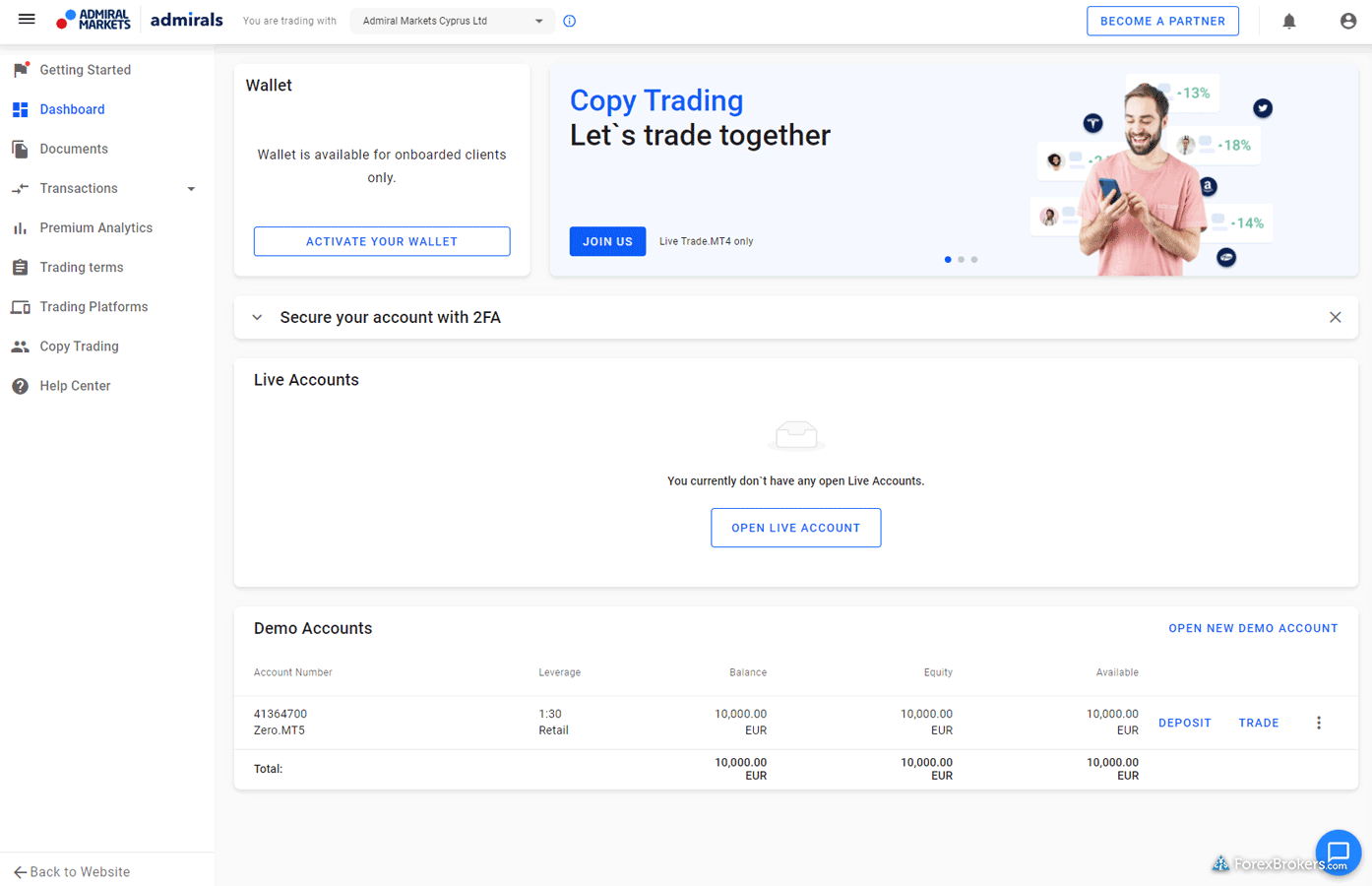

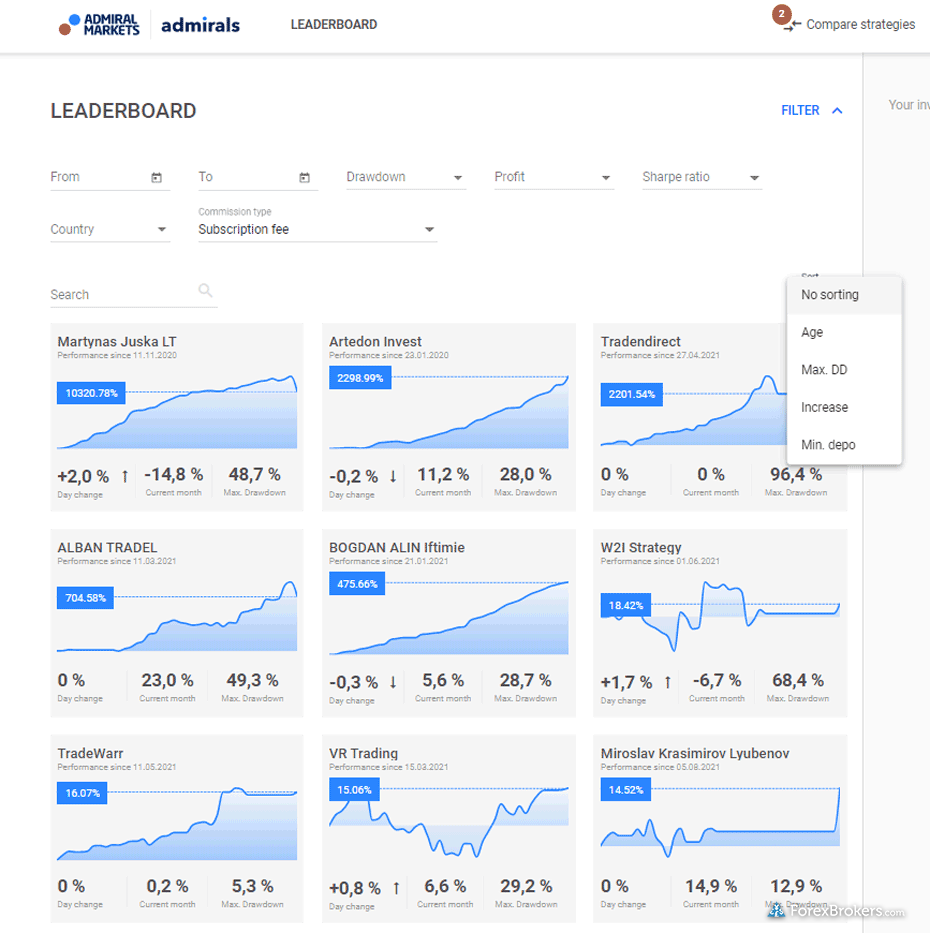

- The social trading feature is new to Admiral Markets, but doesn’t yet stack up against competitors like eToro and ZuluTrade.

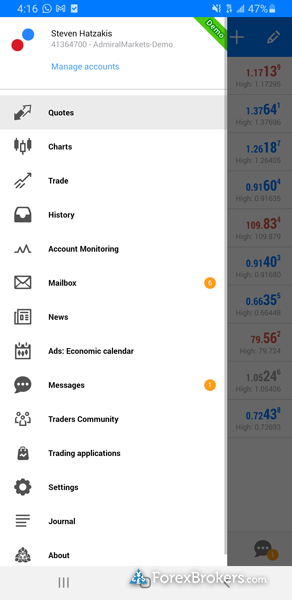

- Admiral Markets App is still relatively unsophisticated.

Admirals (Admiral Markets) review summary

Admirals (Admiral Markets) is a Global forex and CFD broker founded in 2001. It is overseen by multiple regulators in the various regions it serves. These regulators are the UK’s Financial Conduct Authority (FCA), the Estonian Financial Supervision Authority (EFSA), the Cyprus Securities and Exchange Commission (CySEC), the Australian Securities and Investment Commission (ASIC) and the Jordan Securities Commission (JSC). Of these, the FCA and the ASIC are top-tier financial authorities.

Admirals is a safe-trade place because it has a long track record, discloses its financials, and its parent company, the Admirals Group is listed on a stock exchange.

Admirals or Admiral Markets, but it is currently going through a rebranding process. This should be of no concern to clients, as this doesn’t affect the broker’s services in any negative way.

Disclaimer: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 81% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Investment Programs, Available Markets and Products of the Broker

Admiral Markets is currently among the largest brokerage companies offering services to Forex investors and traders. There use high-quality software providing the maximum convenience of transactions, regardless of the time the transaction was concluded, at the broker’s user’s disposal. The analytics’ section facilitates the work on Forex, as it is possible to study the fundamental and technical analysis data.

Admiral Markets possibilities

Admiral Markets provides the capability to automate the trade execution process using your terminal. For example, in MetaTrader 4 there is a function for copying transactions, providing that the user shall install several software versions on his device with mandatory separation into folders. This allows you to use multiple accounts at once. Automated trading and permission to use dynamic libraries setting up is a mandatory requirement. Likewise, a trader with multiple PCs for stock trading operations can be performed in this class. Rapid copying of transactions between accounts, which allows you to synchronize parameters instantly.

Detailed Review of Admiral Markets

Admiral Markets is among the largest and well-known brokerage companies currently operating and providing its services to Forex investors and traders on the exchange market.

As of 2020, Admiral Markets has representative offices in many European countries, providing each client with qualified assistance. It is the same situation with the official web resource interface.

Company Features:

-

for over 13 years of active business in Eastern Europe;

-

annual turnover — over USD 40 billion.

-

millions of users around the world.

Admiral Markets platforms and tools

2022 Review Methodology

For our 2022 Forex Broker Review we assessed, rated, and ranked 39 international forex brokers over a three-month time period resulting in over 50,000 words of published research.

There are a total of 113 different variables, including our proprietary Trust Score algorithm., including our proprietary Trust Score algorithm. This innovative scoring system ranks the level of trustworthiness for each broker based on factors such as licenses, regulation and corporate structure. Read about Trust Score here.

As part of our annual review process, all brokers had the opportunity to provide updates and key milestones and complete an in-depth data profile, which we hand-checked for accuracy.

Ultimately, our rigorous data validation process yields an error rate of less than .1% each year, providing site visitors with quality data they can trust. Learn more about how we test.

Forex Risk Disclaimer

There is a very high degree of risk involved in trading securities. With respect to margin-based foreign exchange trading, off-exchange derivatives, and cryptocurrencies, there is considerable exposure to risk, including but not limited to, leverage, creditworthiness, limited regulatory protection and market volatility that may substantially affect the price, or liquidity of a currency or related instrument. It should not be assumed that the methods, techniques, or indicators presented in these products will be profitable, or that they will not result in losses. Read more on forex trading risks.

Reviews

There are no reviews yet.