Overview

Trust score

Tradeable Symbols (Total): 8425

Year Founded: 2011

Publicly Traded (Listed): No

Bank: No

ADSS is considered low-risk, with an overall Trust Score of 90 out of 99. ADSS is not publicly traded and does not operate a bank. ADSS is authorised by two tier-1 regulators (high trust), one tier-2 regulator (average trust), and zero tier-3 regulators (low trust). ADSS is authorised by the following tier-1 regulators: Securities Futures Commission (SFC) and the Financial Conduct Authority (FCA). Learn more about Trust Score.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

While ADSS markets its proprietary OREX trading platform alongside MetaTrader, we found the broker to be underwhelming. Customer service quality is terrible, and ADSS trails industry leaders in key areas, including trading tools and research.

Pros 👍🏻

No

Cons 👎🏻

No

Top Takeaways with ADSS

Here are our top findings on ADSS:

- Founded in 2011, ADSS is regulated in two tier-1 jurisdictions and one tier-two jurisdiction, making it a safe broker (low-risk) for forex and CFDs trading.

- Alongside MetaTrader, ADSS offers its proprietary platform suite, OREX, which we found to be just “ok” when compared to trading platforms from IG, Saxo Bank, and Dukascopy.

- While ADSS offers social copy trading, we found it doesn’t stack up well against category leaders. Education and research were also a bit underwhelming, which doesn’t make the broker a great fit for beginners.

Overall Summary

Please Note: ADSS was not included in our last annual review. As a result, this broker’s ratings may be outdated. Read our best forex brokers guide for a breakdown of the top rated forex and CFDs brokers.

The ForexBrokers.com annual forex broker review (six years running) is the most cited in the industry. With over 50,000 words of research across the site, we spend hundreds of hours testing forex brokers each year. Here’s how we test.

Offering of Investments

The following table summarizes the different investment products available to ADSS clients.

Cryptocurrency: Cryptocurrency trading is available through CFDs, but not available through trading the underlying asset (e.g. buying Bitcoin). Note: Crypto CFDs are not available to retail traders from any broker’s UK entity, nor to UK residents.

| Feature |  |

| Forex Trading (Spot or CFDs) | Yes |

| Tradeable Symbols (Total) | 2200 |

| Forex Pairs (Total) | 56 |

| U.S. Stock Trading (Non CFD) | No |

| Int’l Stock Trading (Non CFD) | Yes |

| Social Trading / Copy Trading | Yes |

| Cryptocurrency (Physical) | No |

| Cryptocurrency (CFD) | Yes |

| Disclaimers | Note: Crypto CFDs are not available to retail traders from any broker’s U.K. entity, nor to U.K. residents (except to Professional clients). |

ADSS Commissions and Fees

ADSS commissions and fees vary depending on the account type established, and the range of available account types differ depending on the ADSS brand that you choose, which is related to your location and the applicable regulatory jurisdiction.

UAE-based accounts: From its UAE-based hub, ADSS offers two accounts: Classic, and Elite. The Classic version had its minimum deposit reduced to $100, making it more affordable for the most conservative traders, yet carries higher spreads than the Elite account type. In the Classic account, target spreads drop to 1.6 pips on the EUR/USD. In contrast, ADSS’s most competitive offering is the Elite account, akin to a VIP-style account, which requires a $200,000 deposit or trading volume of more than $500 million per month and comes with perks beyond discounted spreads.

Hong Kong accounts: At ADSS Hong Kong, the firm lists an average spread of 1 pip for the EUR/USD pair from its OREX platform, and offers a bullion account, in addition to securities and futures trading from its TREX platform which requires a deposit of at least $3000.

| Feature |  |

| Minimum Initial Deposit | £100 |

| Average Spread EUR/USD – Standard | 1 |

| All-in Cost EUR/USD – Active | N/A |

| Active Trader or VIP Discounts | Yes |

| Execution: Agency Broker | Yes |

| Execution: Market Maker | Yes |

ADSS Platforms and Tools

ADSS goes beyond the normal MetaTrader-only broker to customize its offering by providing add-ons as well as Autochartist and VPS hosting.

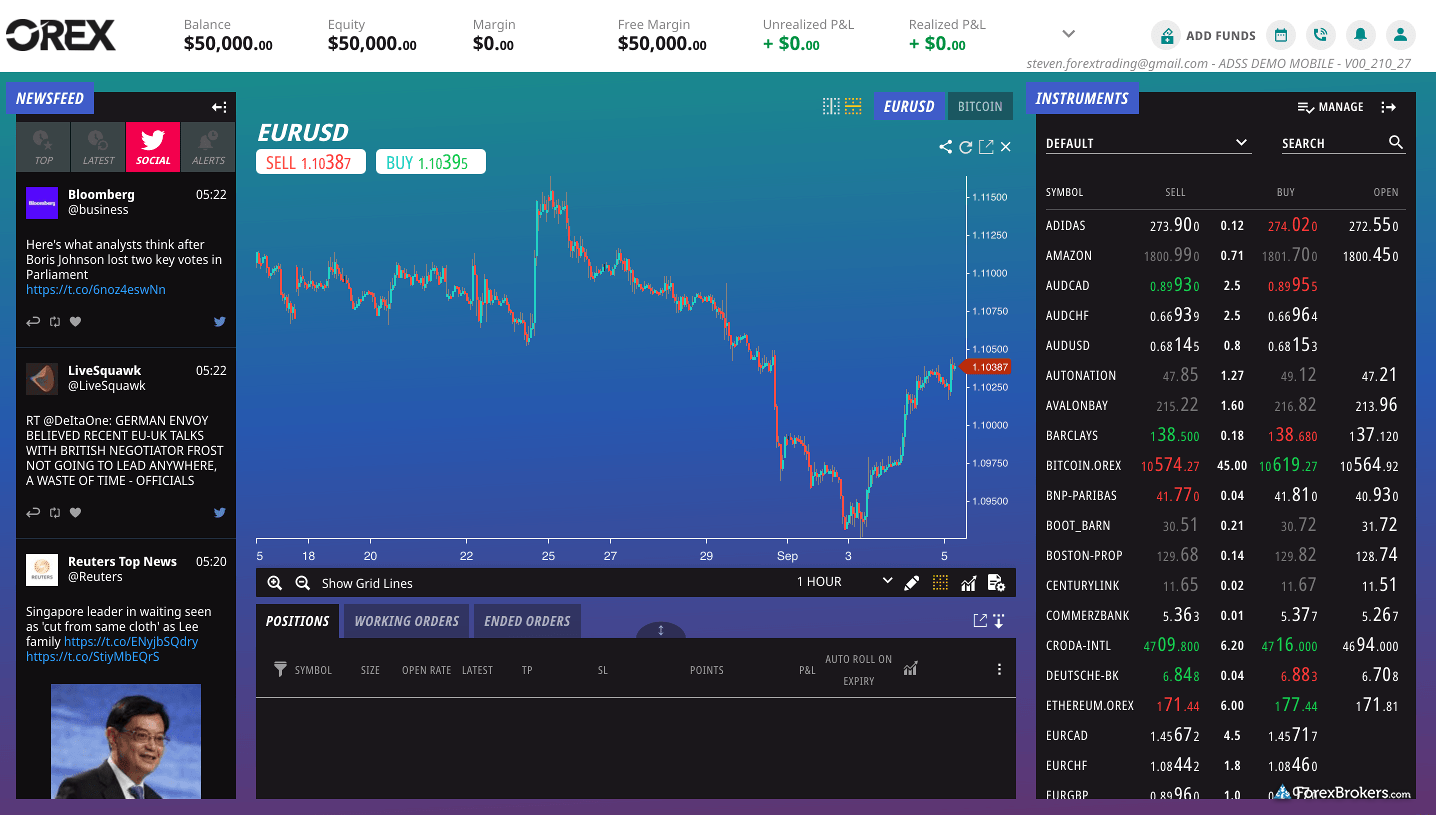

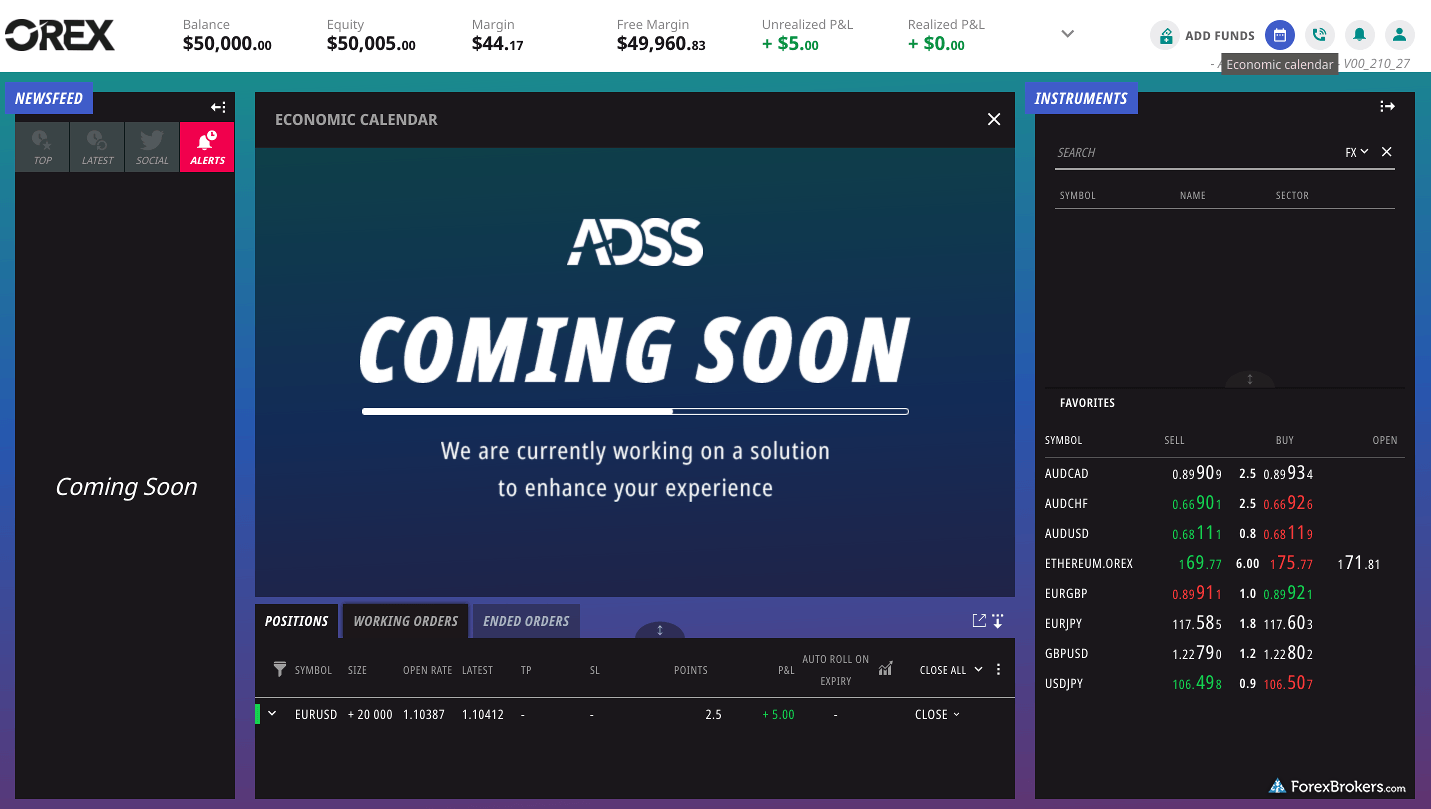

OREX web: ADSS’s flagship OREX web platform has a greater product range compared to its MT4 platform offering and is simple, minimalistic, and generally easy to navigate. However, during our testing, we found that the OREX web version still contains unfinished modules, such as the alerts and economic calendar sections labeled “coming soon.”

OREX desktop: While the firm also offers OREX Optim, a desktop version of the platform, it relies on Silverlight, which is an outdated plugin, making it inaccessible to download using mainstream browsers. As a result, I do not recommend the Orex Optim desktop version.

| Feature |  |

| Virtual Trading (Demo) | Yes |

| Proprietary Platform | Yes |

| Desktop Platform (Windows) | Yes |

| Web Platform | Yes |

| Social Trading / Copy Trading | Yes |

| MetaTrader 4 (MT4) | Yes |

| MetaTrader 5 (MT5) | No |

| DupliTrade | No |

| ZuluTrade | Yes |

| Charting – Indicators / Studies (Total) | (Default MT4) 116 in Orex |

| Charting – Drawing Tools (Total) | (Default MT4) 35 in Orex |

| Charting – Trade From Chart | Yes |

| Watchlists – Total Fields | (Default MT4) |

ADSS Research

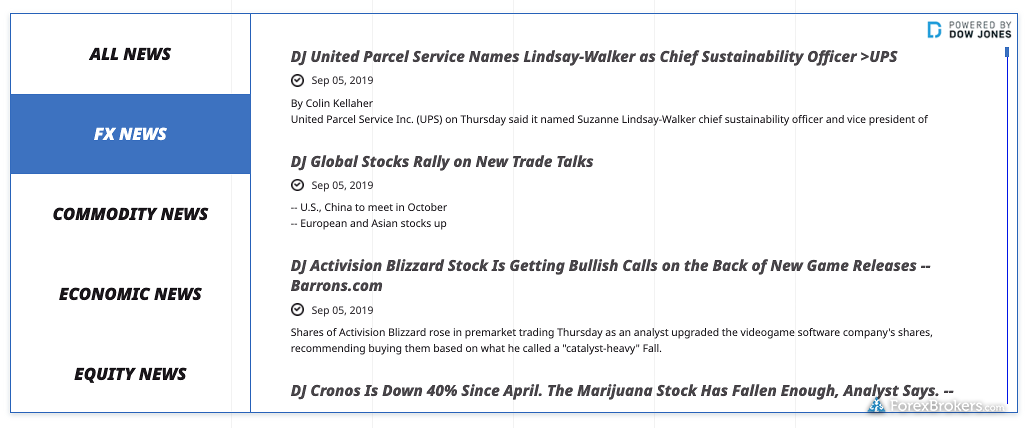

ADSS has just an average selection of research content across its website and trading platform, ranging from sentiment widgets to earnings calendars, in addition to industry-standard news from top-tier providers such as Dow Jones.

Social copy trading: While the broker is not an industry leader for social copy trading, ADSS does offer copy trading through its Prime and Classic accounts.

| Feature |  |

| Daily Market Commentary | Yes |

| Forex News (Top-Tier Sources) | Yes |

| Autochartist | Yes |

| Trading Central (Recognia) | No |

| Social Sentiment – Currency Pairs | Yes |

Mobile Trading

Besides the native MT4 mobile app, ADSS offers its proprietary OREX platform for mobile Android and iOS devices. Our testing focused on the OREX mobile app.

OREX Mobile app good stuff: The OREX mobile app contains general and economic news together with an earnings calendar. Charting also is respectable once launched into full-screen mode and includes 63 indicators and 25 candlestick patterns. Lastly, the Market Insights section contains sentiment analysis, including probabilities weightings (e.g., the confidence level of the signal strength).

OREX Mobile app bad stuff: Beyond research and a basic watchlist, the rest of the OREX mobile app is light on features and has a few minor bugs. For example, sentiment analysis is available under the Market Insights section, although other categories such as Energy and Technology return an error message.

Customer Service

To score Customer Service, ForexBrokers.com partnered with customer experience research group Customerwise to conduct phone tests from locations throughout the UK. For our 2020 Review, 330 customer service tests were conducted over six weeks.

- Average Connection Time: >5 minutes

- Average Net Promoter Score: 1.0 / 10

- Average Professionalism Score: 0 / 10

- Overall Score: 0.75 / 10

- Ranking: 22 nd (22 brokers)

Final Thoughts

With the OREX platform suite serving as a good foundation for the company’s retail trading platform, ADSS goes beyond the typical MetaTrader brokerage by offering extra add-ons for MT4 and provides forex traders over 60 currency pairs and 2200 CFDs.

ADSS can be a great choice for active forex traders and those with large balances, such as professional day traders and high net worth clients due to the VIP-style account offerings and related perks. Just keep in mind that the choice of where you can open an account may be limited by your location.

About ADSS

Founded in 2011 in Abu Dhabi with $400 million in initial capital, ADSS (Formerly ADS Securities) has since developed into a global brand, with regulated entities in Hong Kong, the United Kingdom (UK), and the United Arab Emirates (UAE).

ADSS caters to retail traders through its ADSS brand in the UK for EU Citizens, and ADS Prime in the UAE for clients in the Gulf and other countries, whereas clients in Asia can choose the firm’s Hong Kong entity which also offers exchange-traded securities and futures trading, with support in Singapore giving the firm good regional coverage across EURASIA. Read more on Wikipedia about ADSS.

2022 Review Methodology

For our 2022 Forex Broker Review we assessed, rated, and ranked 39 international forex brokers over a three-month time period resulting in over 50,000 words of published research.

Each broker was graded on 113 different variables, including our proprietary Trust Score algorithm. This innovative scoring system ranks the level of trustworthiness for each broker based on factors such as licenses, regulation and corporate structure. Read about Trust Score here.

As part of our annual review process, all brokers had the opportunity to provide updates and key milestones and complete an in-depth data profile, which we hand-checked for accuracy.

Ultimately, our rigorous data validation process yields an error rate of less than .1% each year, providing site visitors with quality data they can trust. Learn more about how we test.

Forex Risk Disclaimer

There is a very high degree of risk involved in trading securities. With respect to margin-based foreign exchange trading, off-exchange derivatives, and cryptocurrencies, there is considerable exposure to risk, including but not limited to, leverage, creditworthiness, limited regulatory protection and market volatility that may substantially affect the price, or liquidity of a currency or related instrument. It should not be assumed that the methods, techniques, or indicators presented in these products will be profitable, or that they will not result in losses. Read more on forex trading risks.

Reviews

There are no reviews yet.