Overview

Trust score

Tradeable Symbols (Total): 26000

Year Founded: 2014

Publicly Traded (Listed): No

Bank: No

BlackBull Markets is considered average-risk, with an overall Trust Score of 74 out of 99. BlackBull Markets is not publicly traded, does not operate a bank, and is authorised by one tier-1 regulators (high trust), zero tier-2 regulator (average trust), and zero tier-3 regulators (low trust). BlackBull Markets is authorised by the following tier-1 regulators: Financial Markets Authority (FMA) – New Zealand. Learn more about Trust Score.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 74-89% of retail CFD accounts lose money You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

BlackBull Markets is a plain-vanilla MetaTrader broker with a growing range of products and support for a handful of third-party social copy trading platforms.

However, its sparse education and modest research materials leave BlackBull Markets struggling to compete with the best forex brokers.

Pros 👍🏻

- Available to residents of New Zealand – unlike many brokers that don’t have the required full FMA license.

- Provides the full MetaTrader suite (MT4 and MT5).

- Supports multiple third-party copy trading platforms, such as ZuluTrade and Myfxbook.

- Integration with the TradingView web platform was made available in 2021.

Cons 👎🏻

- Besides in New Zealand, lacks additional tier-one regulatory licenses, such as within the EU.

- BlackBull’s Seychelles-licensed entity only offers light regulatory protection.

- The narrow scope of BlackBull’s research and educational content can’t compete with what the best MetaTrader brokers offer.

- Based on the average spreads we obtained, commissions and fees at BlackBull Markets appear to be in line with the industry average.

- With only 281 symbols available for trading on MetaTrader, BlackBull Markets trails the best forex brokers.

Offering of investments

BlackBull Markets offers a total of 281 tradeable symbols, which is just about average for the industry. The table below summarizes the different investment products available to BlackBull Markets clients.

Cryptocurrency: Cryptocurrency trading is available at BlackBull Markets through CFDs, but not available through trading the underlying asset (e.g. buying Bitcoin). Note: Crypto CFDs are not available to retail traders from any broker’s U.K. entity, nor to U.K. residents.

| Feature |  |

| Forex Trading (Spot or CFDs) | Yes |

| Tradeable Symbols (Total) | 26000 |

| Forex Pairs (Total) | 72 |

| U.S. Stock Trading (Non CFD) | Yes |

| Int’l Stock Trading (Non CFD) | Yes |

| Social Trading / Copy Trading | Yes |

| Cryptocurrency (Physical) | No |

| Cryptocurrency (CFD) | Yes |

| Disclaimers | Note: Crypto CFDs are not available to retail traders from any broker’s U.K. entity, nor to U.K. residents (except to Professional clients). |

Commissions and fees

Trading costs at BlackBull Markets are about average for the industry, and will vary depending on which of its three account types you choose.

Spreads: The average spread for the Standard account came to 1.25 pips in October 2021, making it a pricier option than BlackBull Markets’ ECN Prime account (my preferred choice). After including the round-trip commission equivalent of 0.6 pips per trade on the ECN Prime account, the effective average spread for the EUR/USD is 0.824 for October 2021.

Accounts comparison: The Standard account is commission-free and has no minimum deposit requirement. The ECN Prime account offers lower spreads, but requires a $2,000 minimum deposit, and there is a commission of $3 per side or $6 round turn per lot. The ECN Institutional account is BlackBull’s more exclusive option for active traders that deposit at least $20,000, with commission rates that are negotiated with the broker on a case-by-case basis.

| Feature |  |

| Minimum Initial Deposit | $0 |

| Average Spread EUR/USD – Standard | 0.827 (August 2022) |

| All-in Cost EUR/USD – Active | 0.827 (August 2022) |

| Active Trader or VIP Discounts | Yes |

| Execution: Agency Broker | No |

| Execution: Market Maker | Yes |

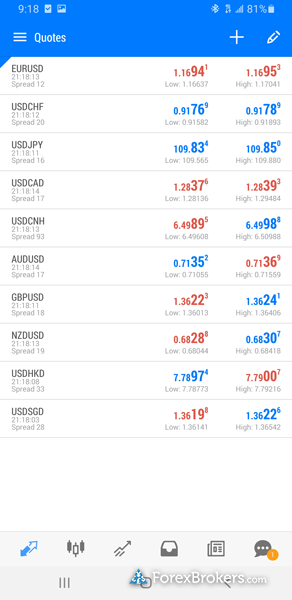

Mobile trading apps

With no proprietary mobile app available, BlackBull Markets trails behind industry leaders such as IG and Saxo Bank. For our top picks among trading apps, read our guide to Best Forex Trading Apps.

Apps overview: As BlackBull Markets is a MetaTrader-only broker, iOS and Android versions of the MetaTrader 4 (MT4) and MetaTrader 5 (MT5) app come standard and are both available for download from the Apple App Store and Google Play store, respectively.

| Feature |  |

| Android App | Yes |

| Apple iOS App | Yes |

| Mobile Alerts – Basic Fields | Yes |

| Watchlists – Total Fields | 7 |

| Watchlist Syncing | No |

| Charting – Indicators / Studies (Total) | 30 |

| Charting – Drawing Tools (Total) | 15 |

| Mobile Charting – Draw Trendlines | Yes |

| Charting – Multiple Time Frames | No |

| Forex Calendar | Yes |

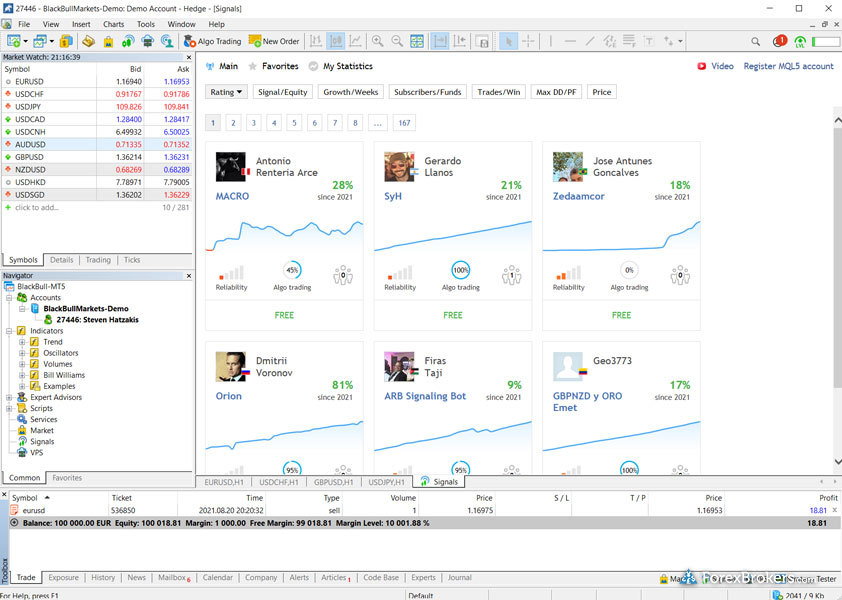

Other trading platforms

BlackBull Markets is predominantly a MetaTrader broker, offering the MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platform suite for desktop and web.

Platforms overview: With a limited range of markets and no platform add-ons, there is simply not much to say about the broker’s MT4 offering. The special features that are available come by way of third-party providers, such as support for Virtual Private Servers (VPS) hosting and the integration of third-party social copy trading apps. Besides MetaTrader, TradingView and HokoCloud are also available at BlackBull Markets.

Social copy trading: BlackBull Markets offers several third-party apps for social copy trading, in addition to the native Signals market available in MT4. Supported copy trading platforms include ZuluTrade and MyFxbook.

VPS hosting: For algorithmic traders that want to run their MetaTrader platform 24-7 from a Virtual Private Server (VPS), BlackBull Markets offers VPS service from BeeksFX for a monthly fee. Free VPS service is also available if you deposit at least $2,000 in the ECN Prime account and complete at least 20 standard lots (2,000,000 units worth of trading volume) each month.

| Feature |  |

| Virtual Trading (Demo) | Yes |

| Proprietary Platform | No |

| Desktop Platform (Windows) | Yes |

| Web Platform | Yes |

| Social Trading / Copy Trading | Yes |

| MetaTrader 4 (MT4) | Yes |

| MetaTrader 5 (MT5) | Yes |

| DupliTrade | No |

| ZuluTrade | Yes |

| Charting – Indicators / Studies (Total) | 30 |

| Charting – Drawing Tools (Total) | 15 |

| Charting – Trade From Chart | Yes |

| Watchlists – Total Fields | 7 |

Market Research

BlackBull Markets doesn’t offer comprehensive market research coverage in written or audio-visual format, compared to the best forex and CFD brokers in this category.

Research overview: BlackBull Markets produces a daily series featuring technical and fundamental analysis for specific trading symbols. For example, the Trade in 60 Seconds series are one-minute recordings that focus on a particular trading symbol – such as a given forex pair or CFD.

Market news and analysis: Both the Market Reviews articles and the selection of videos produced by BlackBull Markets’ in-house team are high-quality, and provide depth from a technical and fundamental analysis perspective. I was just disappointed to find that there isn’t more daily content.

Resuming the production of live streams would be a step in the right direction for BlackBull Markets, along with a general expansion of daily content.

| Feature |  |

| Daily Market Commentary | Yes |

| Forex News (Top-Tier Sources) | No |

| Autochartist | Yes |

| Trading Central (Recognia) | No |

| Social Sentiment – Currency Pairs | No |

Education

BlackBull Markets’ overall educational offering has a long way to go to catch up to the best forex brokers for beginners.

Learning center: BlackBull Markets hosts a section on its website dedicated to education, with categories such as “Learn To Trade.” However, these are mostly devoid of comprehensive materials. The only videos available in this section are platform tutorials, which – while helpful from a product standpoint – is not content I’d consider to be educational. That said, it is worth mentioning that BlackBull Markets has created a series of educational videos on its YouTube channel. I found these to be of decent quality, such as its Whiteboard Wizards playlist.

| Feature |  |

| Has Education – Forex or CFDs | No |

| Client Webinars | No |

| Client Webinars (Archived) | Yes |

| Videos – Beginner Trading Videos | Yes |

| Videos – Advanced Trading Videos | No |

| Investor Dictionary (Glossary) | Yes |

Final thoughts

Despite a growing product range on MetaTrader and support for social copy trading tools, BlackBull Markets falls behind the best brokers in several key categories, such as education and research. It’s also important to note that BlackBull Markets currently has a relatively low Trust Score, due to its small number of regulatory licenses.

BlackBull Markets is fairly new to the brokerage scene, and has plenty of room to grow in order to become competitive. Until it does, there are more trusted brokers available.

About BlackBull Markets

Founded in 2014, BlackBull Markets is a forex and CFD broker headquartered in New Zealand. The broker has been fully authorized by the Financial Markets Authority (FMA) in New Zealand since 2020, and registered on the Financial Services Provider Register (FSPR) since the end of 2014. The BlackBull Markets brand also holds a license in the offshore island nation of Seychelles with the Financial Services Authority (FSA).

2022 Review Methodology

For our 2022 Forex Broker Review we assessed, rated, and ranked 39 international forex brokers over a three-month time period resulting in over 50,000 words of published research.

Each broker was graded on 113 different variables, including our proprietary Trust Score algorithm. This innovative scoring system ranks the level of trustworthiness for each broker based on factors such as licenses, regulation and corporate structure. Read about Trust Score here.

As part of our annual review process, all brokers had the opportunity to provide updates and key milestones and complete an in-depth data profile, which we hand-checked for accuracy.

Ultimately, our rigorous data validation process yields an error rate of less than .1% each year, providing site visitors with quality data they can trust. Learn more about how we test.

Forex Risk Disclaimer

There is a very high degree of risk involved in trading securities. With respect to margin-based foreign exchange trading, off-exchange derivatives, and cryptocurrencies, there is considerable exposure to risk, including but not limited to, leverage, creditworthiness, limited regulatory protection and market volatility that may substantially affect the price, or liquidity of a currency or related instrument. It should not be assumed that the methods, techniques, or indicators presented in these products will be profitable, or that they will not result in losses. Read more on forex trading risks.

Reviews

There are no reviews yet.