Deriv offers complex derivatives, such as options and contracts for difference (“CFDs”). These products may not be suitable for all clients, and trading them puts you at risk. Please make sure that you understand the following risks before trading Deriv products: a) you may lose some or all of the money you invest in the trade, b) if your trade involves currency conversion, exchange rates will affect your profit and loss. You should never trade with borrowed money or with money that you cannot afford to lose.

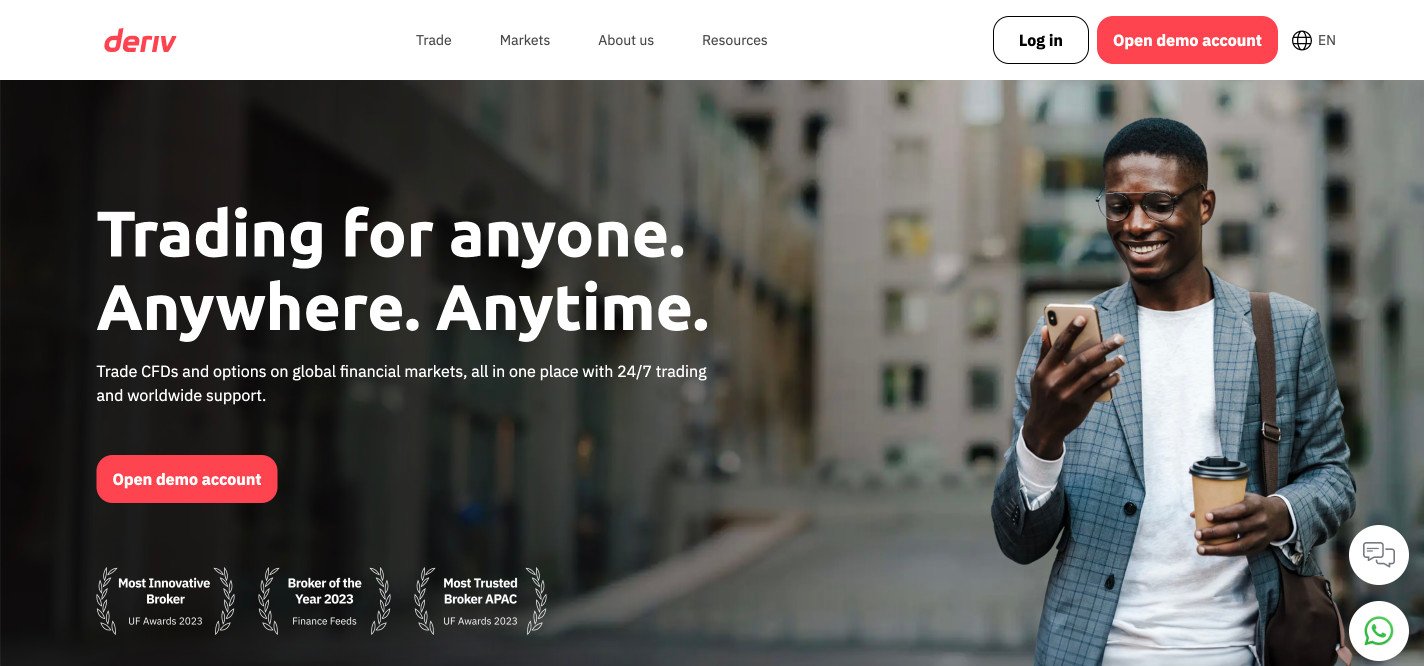

Introduction to Deriv

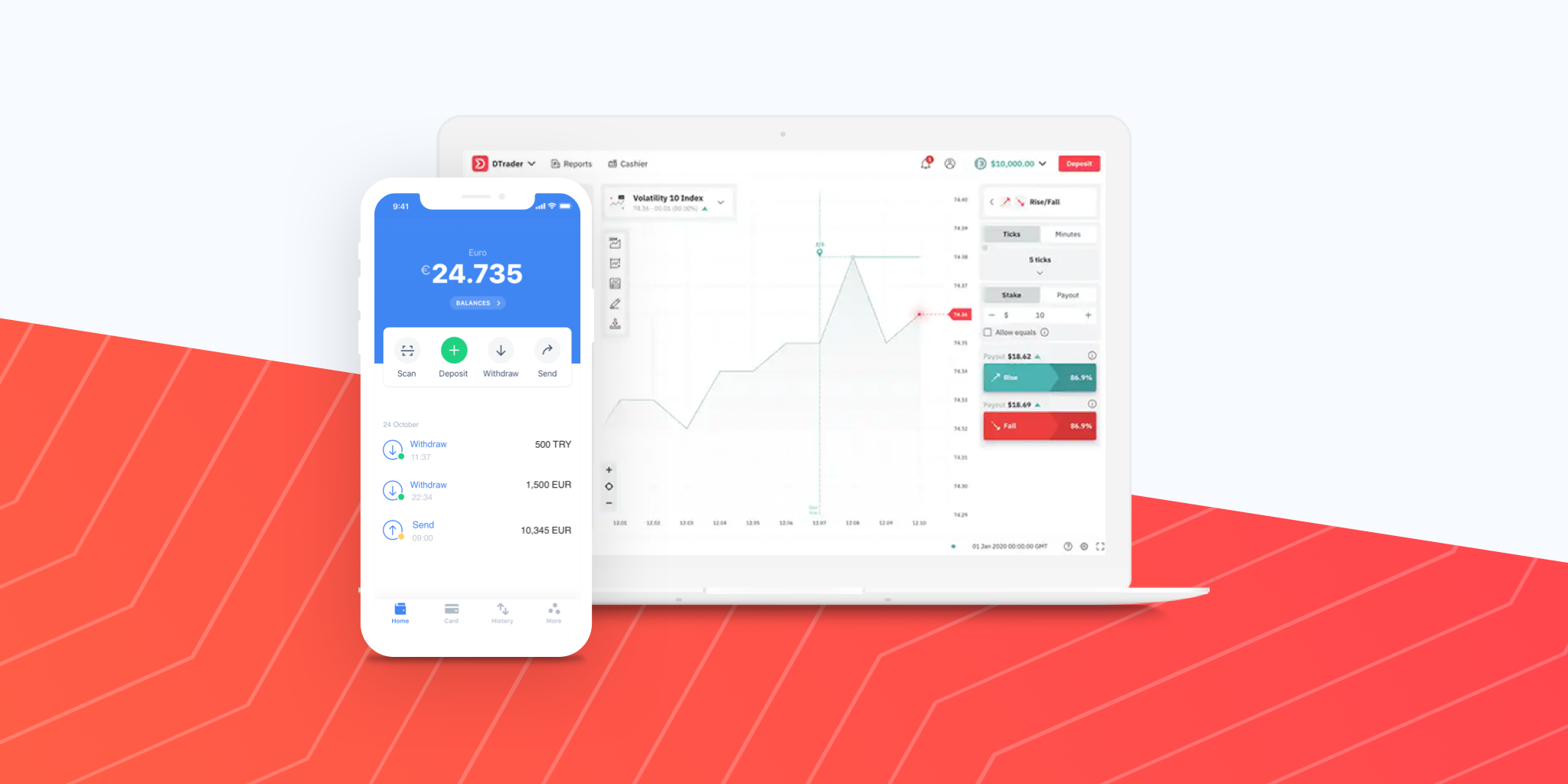

Deriv is a prominent online trading platform launched in 2020, built on the strong foundation of Binary.com, a well-known and respected binary options broker. Over the years, Deriv has evolved into a versatile platform that caters to traders globally, offering a wide variety of financial instruments, intuitive platforms, and robust trading tools. As we enter 2024, Deriv continues to maintain its place as a reputable broker, providing competitive services in the world of online trading.

Trading Platforms Offered

.webp)

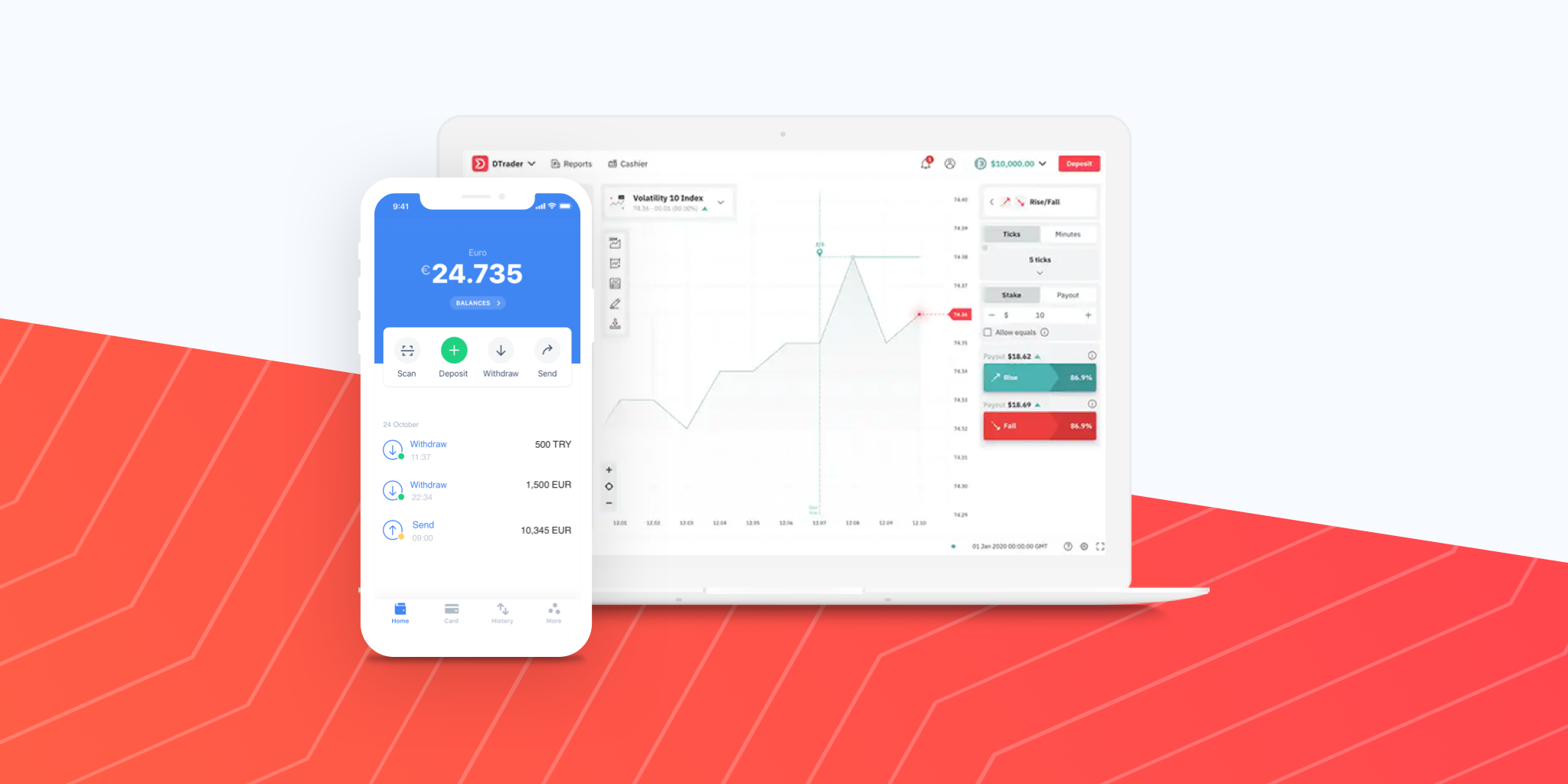

Deriv offers a range of innovative platforms tailored to suit different trading needs. These include:

DTrader: A user-friendly web-based platform designed for simplicity. Traders can choose from a wide range of assets and enjoy customizable charts, multiple timeframes, and intuitive controls.

DBot: This is a unique, automated trading platform that allows users to build trading bots without coding skills. DBot offers drag-and-drop functionality, enabling traders to automate strategies with ease.

MetaTrader 5 (MT5): One of the most advanced platforms available, MT5 offers comprehensive trading features, advanced charting tools, and multiple timeframes. It supports CFD trading across forex, stocks, commodities, and cryptocurrencies.

SmartTrader: Deriv’s traditional trading platform for binary options, continuing the legacy of Binary.com. This platform remains simple and effective for those focused on binary options trading.

DerivX: A highly customizable CFD trading platform with multiple asset classes, intuitive UI, and risk management features, aimed at advanced traders.

Trading Instruments

Deriv provides a broad array of trading instruments, enabling users to diversify their portfolios:

Forex: Deriv offers more than 50 forex pairs, including major, minor, and exotic currencies. This makes it ideal for forex traders looking for variety.

Commodities: Traders can access popular commodities such as gold, silver, and oil, allowing for safe-haven investments and trading on global economic trends.

Stocks & Indices: With CFDs on major stock indices like NASDAQ, FTSE, and Nikkei, and individual shares from global companies, Deriv gives traders a chance to speculate on stock market movements.

Cryptocurrencies: Deriv allows for crypto trading, including popular assets like Bitcoin, Ethereum, and Litecoin. With 24/7 availability, crypto trading on Deriv provides excellent flexibility.

Synthetic Indices: One of Deriv’s most unique offerings, synthetic indices are indices not tied to real-world markets but instead emulate real market volatility. This asset class operates 24/7, offering round-the-clock trading opportunities.

Account Types

Deriv caters to various traders by offering a wide range of account types. These include:

Standard Account: This account is ideal for most traders, offering access to all the platform’s instruments and features with competitive spreads and leverage.

Synthetic Account: For those specifically interested in trading synthetic indices, Deriv offers a dedicated account tailored to this unique asset class.

Demo Account: New traders can get accustomed to the platform and practice strategies risk-free with the demo account. It mirrors live market conditions, providing a great learning environment.

Financial STP Account: For advanced traders, this account offers tighter spreads and direct access to the interbank forex market, providing better pricing.

Regulation and Security

Deriv is well-regulated and operates under the watchful eyes of several financial authorities. Its entities are licensed by the Malta Financial Services Authority (MFSA), Vanuatu Financial Services Commission (VFSC), Labuan Financial Services Authority (LFSA), and the Financial Commission. This ensures that Deriv adheres to international standards and best practices, offering users peace of mind when it comes to security.

Client funds are stored in segregated accounts, separate from the company’s operating funds, and Deriv ensures that all personal and financial information is protected with advanced encryption technologies.

Fees and Spreads

Deriv remains competitive in its fee structure, with low spreads starting from 0.1 pips on certain accounts. The platform is transparent, and there are no hidden fees for deposits or withdrawals, although traders may incur third-party charges depending on their chosen payment method. Additionally, Deriv offers leverage of up to 1:1000, allowing for substantial market exposure with a relatively low capital investment.

Deposit and Withdrawal Options

Deriv supports a variety of payment methods, making deposits and withdrawals simple for users around the globe. These methods include:

- Bank Transfers

- Credit/Debit Cards (Visa, Mastercard)

- E-wallets (Skrill, Neteller, Fasapay)

- Cryptocurrency (Bitcoin, Ethereum, Tether)

The minimum deposit is set at a low level, and withdrawal processes are usually swift, with e-wallets and cryptocurrencies providing near-instant access to funds.

Educational Resources and Customer Support

Deriv offers an extensive library of educational content, including webinars, tutorials, and blogs that cover all aspects of trading. Whether you’re a beginner or an experienced trader, the platform provides ample learning resources to improve your trading skills.

Additionally, Deriv provides 24/7 customer support via live chat and email, ensuring that traders receive timely assistance when needed.

Pros and Cons of Deriv

Pros:

Wide variety of trading instruments, including synthetic indices.

Multiple platforms suited for both beginners and advanced traders.

Competitive spreads and low fees.

Strong regulation across multiple jurisdictions.

Customizable automated trading with DBot.

Cons:

Limited crypto assets compared to some other platforms.

No direct access to equities for investors (only through CFDs).

Certain advanced features like leverage might not be suitable for beginners.

Conclusion

As of 2024, Deriv continues to be an excellent choice for both beginner and advanced traders. Its range of trading platforms, including the highly customizable DTrader and DBot, sets it apart from many competitors. With solid regulation, a wide range of instruments, and comprehensive customer support, Deriv provides a secure and innovative environment for global traders.

This detailed review shows that Deriv is not only a reliable broker but one that is constantly evolving to meet the needs of modern traders. Whether you’re interested in forex, CFDs, or synthetic indices, Deriv offers a platform with features to suit your trading style and strategy.

.webp)

Reviews

There are no reviews yet.