Overview

Trust score

Tradeable Symbols (Total): 593

Year Founded: 2004

Publicly Traded (Listed): No

Bank: Yes

Dukascopy is considered low-risk, with an overall Trust Score of 91 out of 99.

Pros 👍🏻

- Dukascopy bank is regulated by FINMA and FSA

- It offers a wide range of tradable assets which include forex, cryptocurrencies, commodities, and several more

- It is regulated under a swiss banking license and by Japan FSA

- Dukascopy offers its users high leverage of 1:200

- It offers a proprietary trading platform described as Jforex

- Dukascopy bank provides a wide range of research tools, banking services, bonus, and trading contests for its traders

Cons 👎🏻

- This platform charges inactivity fees from the traders when they are inactive for over some time

- This platform is not FCA regulated

- Some of the educational tools and products are limited on the platform

- The minimum deposit is $1000, but the traders from Dukascopy Europe can add a minimum deposit of $100

Dukascopy Bank Overview

Offering of Investments

Dukascopy offers a total of 653 symbols to trade across multiple markets covering forex and CFD traders with 60 forex pairs and 593 CFDs. It also offers cryptocurrency trading with CFDs on significant crypto assets, and the actual underlying (non-CFD) across its own launched cryptocurrencies.

Dukascopy Bank: Dukascopy Bank has over 148 million Swiss francs (CHF) in assets on its balance sheet as of June 30, 2019. Also, traders of the broker’s Swiss entity are eligible for 100,000 CHF in insurance protection from the regulatory compensation fund esisuisse.

Dukascoin: Dukascopy offers CFDs on bitcoin and ethereum, and further embraced blockchain technology with the launch of its proprietary cryptocurrency named Dukascoin (DUK+). Note: Crypto CFDs are not available to retail traders from any broker’s UK entity, nor to UK residents.

| Feature |  |

| Forex Trading (Spot or CFDs) | Yes |

| Tradeable Symbols (Total) | 593 |

| Forex Pairs (Total) | 60 |

| U.S. Stock Trading (Non CFD) | No |

| Int’l Stock Trading (Non CFD) | No |

| Social Trading / Copy Trading | Yes |

| Cryptocurrency (Physical) | Yes |

Commissions and Fees

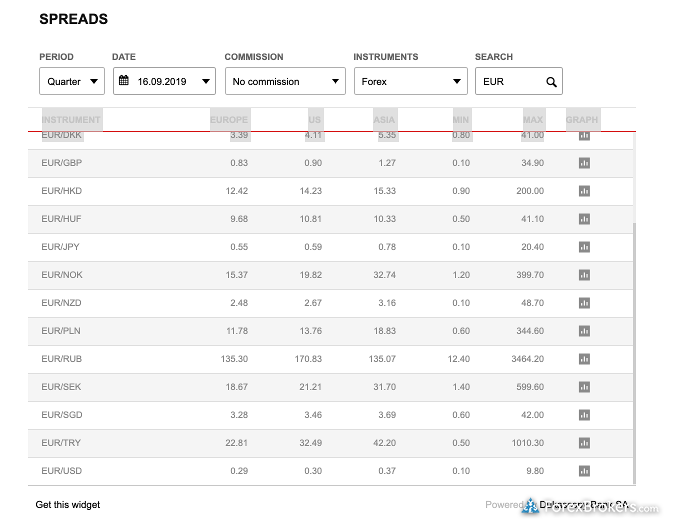

In terms of trading costs, Dukascopy competes near the top among forex brokers that support automated trading and active trading programs.

Account tiers: Dukascopy offers one account type for FX trading under its Forex ECN account, where the execution method can vary between agency and dealing desk. While the spreads are the same for all clients in the ECN account, the added commission rates you pay will vary depending on your trading volume, balance, and net deposits.

Spread data: Using average spreads of 0.30 pips on the EUR/USD for the US trading session during Q3 2019, combined with the default commission rate of 0.70 pips per round turn, the all-in cost equates to 1 pip and is comparable to other brokers with commission-based pricing, such as Saxo Bank.

Swiss versus EU entity: Traders can open the ECN account either with Dukascopy Europe or Dukascopy Bank in Switzerland. The main difference between these two entities, besides regulatory jurisdictions and related investor compensation limits, is that the minimum at the EU entity is much lower at just $100. At the same time, the Swiss entity requires $5,000 – unless you are a Swiss resident, in which case, the minimum drops to $1,000.

Platforms and Tools

Overall, it’s clear that Dukascopy understands trading technology and provides traders the tools they need to succeed. Dukascopy’s flagship platform is JForex 3, a desktop and web-based platform that supports both Windows and Mac. While some forex traders may prefer MetaTrader 4 to a proprietary platform built in house, JForex 3 stands on its own finishing Best in Class for 2020.

JForex 3 desktop is rich with trading tools and easy to use. It’s also fantastic for technical traders, offering 24 drawing tools, 291 technical indicators (67 for the web version), and the ability to import custom indicators. Pros aside, it’s worth noting that zooming in and out of charts on the desktop platform was not as fluid as other platforms tested.

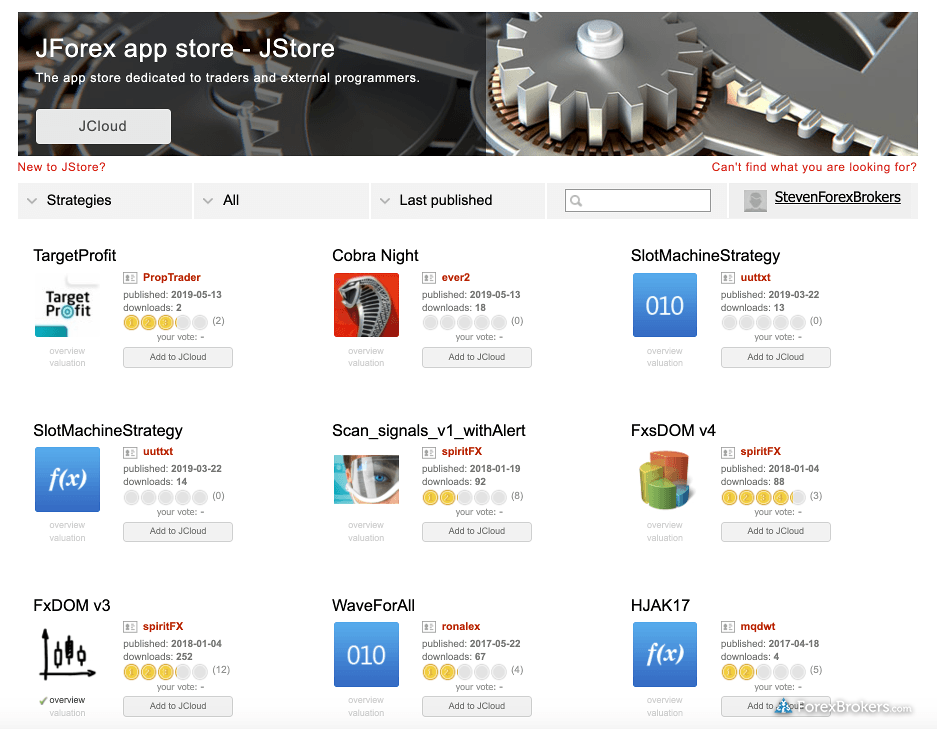

Algorithmic trading: JForex 3 competes well with MetaTrader, as it supports algorithmic trading, custom indicators. Moreover, users have access to cloud storage and VPN services to run their trading systems on a 24-hour basis. Dukascopy also provides an app store with hundreds of apps that traders can use with the JForex 3 platform suite.

Advanced features: In addition to the close all button, which is common in the industry, Dukascopy takes it a step further than most brokers with the ‘cancel all’ button. This feature is convenient to quickly cancel all orders, and something you would typically see used by high-frequency traders and available only via API.

| Feature |  |

| Virtual Trading (Demo) | Yes |

| Proprietary Platform | Yes |

| Desktop Platform (Windows) | Yes |

| Web Platform | Yes |

| Social Trading / Copy Trading | Yes |

| MetaTrader 4 (MT4) | Yes |

| MetaTrader 5 (MT5) | No |

Research

When it comes to forex research, Dukascopy delivers an excellent experience for traders, thanks to a diverse range of research tools in its JForex3 platform for desktop, web, and mobile.

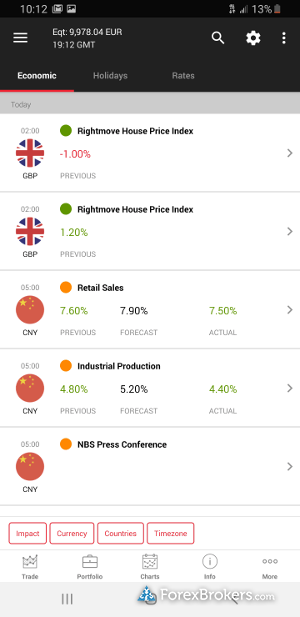

Research tools at Dukascopy include streaming market news from Reuters and MarketPulse, a live economic calendar with consensus forecasts, market sentiment indicators, technical pattern analysis, and automated trading systems within the charting experience.

Dukascopy TV: Dukascopy TV is a professional TV studio in Geneva that broadcasts news from in-house reporters who conduct interviews and market analysis. Not only is the content relevant and insightful, it is also professionally created and educational, making it beneficial for all clients, regardless of skill set.

| Feature |  |

| Daily Market Commentary | Yes |

| Forex News (Top-Tier Sources) | Yes |

| Autochartist | No |

| Trading Central (Recognia) | No |

| Social Sentiment – Currency Pairs | Yes |

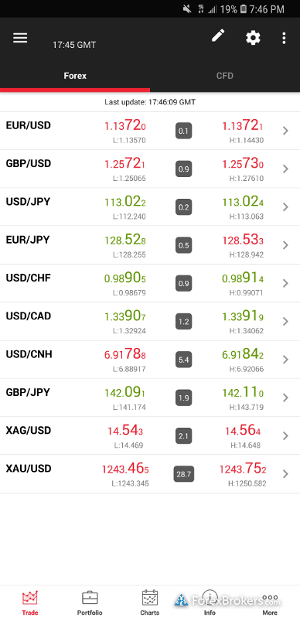

Mobile Trading

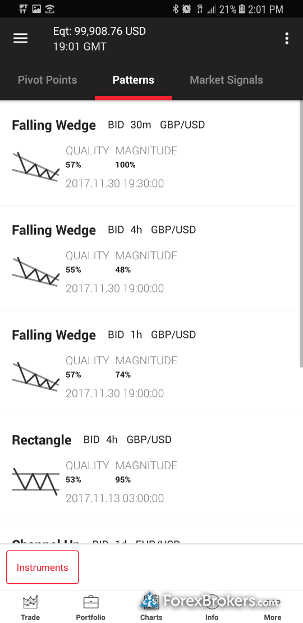

Overall, Dukascopy’s JForex Trader app is the best in the industry, propelling Dukascopy Bank to the top of the podium for mobile trading again in 2020. During tests on my Samsung Galaxy S8+ Edge, several premium features immediately stood out in the app, including integrated market signals and patterns alongside a pivot point tool.

Charting: JForex Trader has robust charting with several customizable parameters and alerts that can easily be added from the same screen. Charting operated seamlessly and was rich with options such as a list of 46 technical indicators – which is above the industry average for mobile trading.

Advanced features: Additional strong points in the app include the level-two quotes and several related order types, including conditional and bid-offer orders, which are available when placing a trade. Strategies can also be selected from a repository within the mobile app that includes strategies created by Dukascopy community members.

Research: The JForex Trader mobile app has an impressive range of research tools, including several pre-defined screens and a clean, customizable view of marker movers, which are adaptable across four different time frames ranging from hourly to monthly. There is also a pattern-recognition tool for trading ideas, organized neatly next to the other research categories.

| Feature |  |

| Android App | Yes |

| Apple iOS App | Yes |

| Mobile Alerts – Basic Fields | Yes |

| Watchlists – Total Fields | 4 |

| Watchlist Syncing | No |

| Charting – Indicators / Studies (Total) | 291 |

| Charting – Drawing Tools (Total) | 24 |

Customer Service

To score Customer Service, ForexBrokers.com partnered with customer experience research group Customerwise to conduct phone tests from locations throughout the UK. For our 2019 Review, 229 customer service tests were conducted over six weeks.

Results

- Average Connection Time: <2 minutes

- Average Net Promoter Score: 4.9 / 10

- Average Professionalism Score: 4.9 / 10

- Overall Score: 3.3 / 10

- Ranking: 18th (23 brokers)

Final Thoughts

Dukascopy Bank is an excellent choice for highly experienced traders, as the broker offers unique tools, research, and competitive rates for active traders. Drawbacks include weaker customer service and a narrow offering of markets available for trading. Nonetheless, Dukascopy is Best In Class across six categories in 2020, including Commissions and Fees, Platform and Tools, Mobile, Crypto Trading, and Overall.

All variables considered Dukascopy finished in 4th place Overall (out of 30 brokers) in our 2020 Review, earning its spot among the highest-rated forex brokers in the industry.

About Dukascopy

In 1998, mathematician Dr. Andre Duka founded Dukascopy Trading Technologies Corp, which led to the development of the Dukascopy trading platform in 1999. Together with his partner, Veronika Makarova, Dr. Duka founded Dukascopy in 2004 as a Swiss brokerage house in Geneva.

After the development of the Swiss FX Marketplace in 2006, Dukascopy acquired a Swiss banking license in 2010 and launched Dukascopy Bank.

The Dukascopy group today employs over 260 staff and offers forex and CFD traders competitive pricing and access to 60 forex pairs and 593 CFD markets on its proprietary JForex platform suite. Read more on Wikipedia about Dukascopy.

2022 Review Methodology

For our 2022 Seven Broker Review we assessed, rated, and ranked 39 international forex brokers over a three-month time period resulting in over 50,000 words of published research.

Each broker was graded on 113 different variables, including our proprietary Trust Score algorithm. This innovative scoring system ranks the level of trustworthiness for each broker based on factors such as licenses, regulation and corporate structure. Read about Trust Score here.

As part of our annual review process, all brokers had the opportunity to provide updates and key milestones and complete an in-depth data profile, which we hand-checked for accuracy.

Ultimately, our rigorous data validation process yields an error rate of less than .1% each year, providing site visitors with quality data they can trust. Learn more about how we test.

Forex Risk Disclaimer

There is a very high degree of risk involved in trading securities. With respect to margin-based foreign exchange trading, off-exchange derivatives, and cryptocurrencies, there is considerable exposure to risk, including but not limited to, leverage, creditworthiness, limited regulatory protection and market volatility that may substantially affect the price, or liquidity of a currency or related instrument. It should not be assumed that the methods, techniques, or indicators presented in these products will be profitable, or that they will not result in losses. Read more on forex trading risks.

Reviews

There are no reviews yet.