Overview

Trust score

Tradeable Symbols (Total):

Year Founded: 2008

Publicly Traded (Listed): Yes

Bank: Yes

Pros

- Raw spreads from 0.0 pips and fast order execution

- Proprietary copy trading platform

- PAMM accounts

- VPS hosting for algorithmic traders

Cons

Limited choice of trading instruments

About NordFx

NordFX operates out of Vanuatu as market maker. The firm offers a range of accounts to suit different trader needs, as well as low minimum deposits, a demo account, plus MT4 integration, and its proprietary copy trading platform. It also maintains PAMM accounts. I reviewed NordFX to determine if their low spreads and fast order execution deserve the awards they received. Should you consider managing a portfolio at NordFX?

Company Overview

NordFX is an international broker with over 14 years of experience in financial markets. Since 2008, the company has been awarded more than 60 prestigious professional awards. The number of accounts opened in NordFX by clients from almost 190 countries has exceeded 1,700,000 as of today. Back to 2008, the founder wanted to create a reliable investing service, and it looks like they succeeded.

NordFX services full range for trading in Forex, gold, silver, crypto, oil, stocks & basic stock indexes such as Nasdaq, Dow Jones, Nikkei etc.

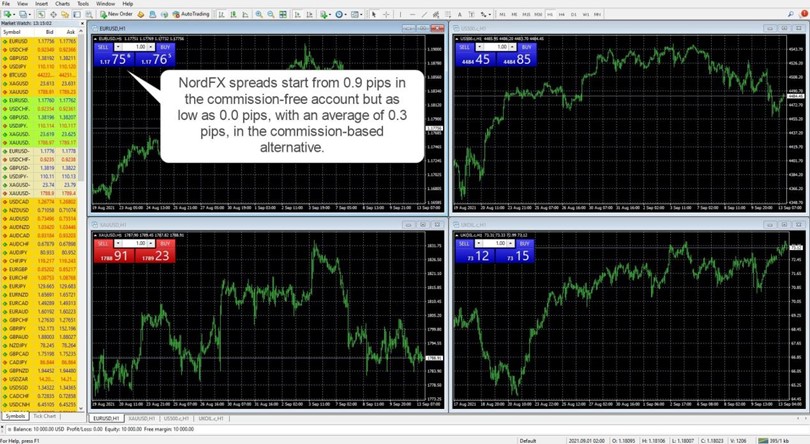

Fees, Commissons and Spreads

Nord FX Fees

The former starts with spreads from 0.9 pips or $9.00 per 1.0 standard lot. The latter shows a minimum of 0.0 pips for a commission of $7.00, but the average mark-up is 0.3 pips, increasing costs to $10.00 per lot. Index CFDs show a fee of 0.05% per round trip versus 0.20% for equity CFDs, matching industry standards.

Nord FX Commissions

NordFX charges a commission rate of 0.0045 per trade lot but only on its Zero Account, Al other accounts do not have a commission charge.

Nord FX Spread

The spreads offered on NordFX are tight, starting from just 0.0 pips. They remain competitive by outsourcing trades to a third-party liquidity provider, which helps keep costs low due to the large trading volumes.

Leverage

NordFX isn’t regulated by the FCA or the ESMA, like many popular brokers. Therefore, the amount of leverage offered is high, with a rating of up to 1:1000.

Account Type

| Account | Min Deposit |  Spreads from Spreads from |

Commission Commission |

| Fix Account | $10 USD /R160 ZAR | from 2 pips | None |

| Pro Account | $250 USD /R4000 ZAR | from 0.9 pips | None |

| Saving Account | $500 USD /R8000 ZAR |  0.0 0.0 |

None None |

| Zero Account | $500 USD /R8000 ZAR |  from 0.0 pips from 0.0 pips |

0,0035% per 0,0035% pertrade (each side) |

Deposit and Withdrawal

When you have an account with a Forex broker, you will find that each company offers different ways to make deposits and withdrawals. Its offers the following methods for both deposit and withdrawal:

- Visa

- Mastercard

- Bank Transfer

- Perfect Money

- Pay Today

- Skrill

Is NordFx safe or scam?

NordFX is regulated by VFSC 15008. A regulated broker equals a more responsible trading environment. You can also expect a more guaranteed safety of funds as some of regulatory frameworks in the financial industry require a compensation scheme in case of unprecedented incidents that result in clients’ financial losses.

Is NordFX legit?

NordFX is a brokerage company offering trading services for clients since 2008 with offices in Cyprus, India and Thailand.

Trading Platform

NordFX uses the popular MetaTrader 4 solution. The terminal is intuitive and simple enough for those new to investing. The options of either managed funds or automated investments are clearly accessible and require limited customization to deploy.

One of the most ignored trading costs is swap rates on leveraged overnight positions. Depending on the trading strategy, it may become the most significant fee per trade. I always recommend that traders check them before evaluating the total trading costs. NordFX offers a positive swap on EUR/USD short positions, meaning traders get paid money.

Customer Support

NordFX has a responsive, knowledgeable customer support team, with 7 specific centers employing dozens of staff to help with inquiries. Users can choose to contact NordFX through a webchat (logo located at the top of the page), via various social channels, or by email at support@nordfx.com. However, if you wish to get hold of support via a phone number, here are a few region-specific options:

- India

- Europe

- China

- Thailand

- Sri Lanka

- LATAM

- Bangladesh

Customer support is available 24/5 and a small FAQ section is also present on the broker’s website. They can help with any questions you may have, including country-specific complaints (like India), demo account login, user agreement issues, and more.

The broker’s owner is NFX Capital VU INC. If you need to contact their headquarters, the office location is Pot 805/103, Rue D’Auvergne, Port Vila, Vanuatu.

Security

NordFX is a relatively safe broker from an operational angle, with trades executed in under half a second. The MetaTrader interface also means users can invest on the go, while the servers are robust and efficient, providing a reliable service for professional, frequent traders.

Final Thought

NordFX is a well-established broker with an exemplary record of performance. They offer some of the lowest spreads on their range of different assets thanks to their ECN liquidity.

They have generous amounts of educational material and offer the most powerful and established trading technology with the MetaTRader4 and MetaTrader5.

FAQ’s

Is NordFX reliable?

NordFX has 13+ years of experience and a regulatory license from the VFSC with a clean track record. Therefore, NordFX is a reliable broker.

How do I withdraw money ?

The secure back office of NordFX handles all withdrawal requests. Traders must first transfer funds from their MT4 terminal to the back office via “Deposit / withdraw funds from the MT4 balance,” and then to their preferred payment processor.

What is the minimum deposit ?

The minimum deposit for Fix is $10, for Pro $250, and for Zero $500.

How many instruments can I trade ?

You can trade several different instruments with NordFX, which include the following:

- CFDs

- Commodities

- Metals

- Stocks

- Oil

- Gold

- Indices

Reviews

There are no reviews yet.