Overview

Trust score

Tradeable Symbols (Total): 80

Year Founded: 2011

Publicly Traded (Listed): No

Bank: No

OctaFX offers three main types of trading accounts, Micro, Pro, and ECN, each with its own set of features and benefits to suit the needs of different traders. The company also offers a range of promotions and bonuses to both new and existing clients.

OctaFX is considered high-risk, with an overall Trust Score of 67 out of 99

Pros 👍🏻

- Competitive trading conditions: OctaFX offers low spreads, fast execution speeds, and no requotes, making it a popular choice for traders.

- Multiple trading platforms: OctaFX provides access to MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader, which are available for desktop, web, and mobile devices, giving traders flexibility and convenience.

- Educational resources: OctaFX offers a range of educational resources, including webinars, trading guides, and video tutorials, to help traders improve their skills and knowledge.

- Range of financial instruments: OctaFX offers access to a range of financial instruments, including forex, commodities, indices, and cryptocurrencies, allowing traders to diversify their portfolios.

- Multiple account types: OctaFX offers three main types of trading accounts, Micro, Pro, and ECN, each with its own set of features and benefits to suit the needs of different traders.

Cons 👎🏻

- Limited regulatory oversight: OctaFX is registered in Saint Vincent and the Grenadines, which is known for having less strict regulations than other jurisdictions.

- Limited customer support: OctaFX provides customer support through email and live chat, but does not offer phone support.

- Limited payment options: OctaFX offers a limited range of payment options compared to other brokers, which may be inconvenient for some traders.

- Inactivity fee: OctaFX charges an inactivity fee of $10 per month if a trader’s account remains inactive for 90 days or more, which may be a deterrent for some traders.

What is OctaFX

OctaFX is an online forex broker that provides trading services in a range of financial instruments, including forex, commodities, indices, and cryptocurrencies. The company was founded in 2011 and is registered in Saint Vincent and the Grenadines. OctaFX offers competitive trading conditions, including low spreads, fast execution speeds, and no requotes. The company provides a range of trading platforms, including MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader, which are available for desktop, web, and mobile devices. OctaFX also offers educational resources, such as webinars, trading guides, and video tutorials, to help traders improve their skills and knowledge.

Investment Products

OctaFX offers fewer than 50 tradeable instruments. By comparison, industry leaders Saxo Bank, IG, and CMC Markets all offer over 10,000 tradeable instruments.

Cryptocurrency: Cryptocurrency trading at OctaFX is available through CFDs, but not available through trading the underlying asset (e.g. buying Bitcoin). Note: Crypto CFDs are not available to retail traders from any broker’s U.K. entity, nor to U.K. residents.

The following table summarizes the products available to OctaFX clients. Find out why you should start with OctaFX.

| Feature |  |

| Forex Trading (Spot or CFDs) | Yes |

| Tradeable Symbols (Total) | 80 |

| Forex Pairs (Total) | 40 |

| U.S. Stock Trading (Non CFD) | No |

| Int’l Stock Trading (Non CFD) | No |

| Social Trading / Copy Trading | Yes |

| Cryptocurrency (Physical) | No |

Fees

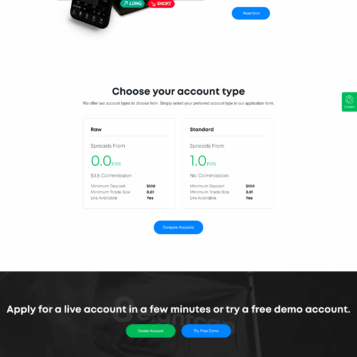

OctaFX has struggled with pricing in the past, but has vastly improved in this category and is now gaining on the lowest-cost MetaTrader brokers.

Account types: Any commissions or fees you pay at OctaFX will depend on your chosen account type and the OctaFX entity under which your account is regulated. European clients will choose the broker’s EU entity, whereas international clients are served from OctaFX’s offshore entity in Saint Vincent and The Grenadines (SVG). In the EU, only MT5 is promoted and thus a single account is available, whereas the SVG entity offers accounts for both MT4 and MT5.

Spreads: OctaFX’s spread pricing varies depending on which of its entities regulates your account. For example, its EU entity is slightly better for the EUR/USD pair at 0.5 pips, compared to 0.7 pips for the SVG entity. It’s worth noting that OctaFX did not provide a date range for its average spread data, and thus the values don’t carry as much weight as spreads that have a corresponding date reference. All in all, OctaFX has improved its pricing and appears to keep pace with the lowest-cost MetaTrader brokers, but with no date range available for its average spread claim, we were unable to make an exact comparison.

Table of OctaFX Fees:

| Fees | Micro Account | Pro Account | ECN Account |

|---|---|---|---|

| Commission | None | None | $3.50 per lot |

| Spread | From 0.4 pips | From 0.2 pips | From 0 pips |

| Maximum Leverage | 1:500 | 1:200 | 1:500 |

Here is an higher version of Octafx Fees in this table below:

| Feature |  |

| Minimum Initial Deposit | $25 |

| Average Spread EUR/USD – Standard | 0.6 (August 2021) |

| All-in Cost EUR/USD – Active | N/A |

| Active Trader or VIP Discounts | No |

| Execution: Agency Broker | Yes |

| Execution: Market Maker | Yes |

Mobile trading apps

OctaFX does have a proprietary app for social copy trading (the OctaFX Copytrading app), yet it still trails behind industry leaders such as IG and Saxo Bank. For our top picks among trading apps, read our guide to Best Forex Trading Apps.

Apps overview: Since OctaFX is a MetaTrader-only broker, iOS and Android versions of the MetaTrader 4 (MT4) and MetaTrader 5 (MT5) app come standard and are both available for download from the Apple App Store and Google Play store, respectively. OctaFX also offers its proprietary OctaFX Copytrading app for social copy trading – which I was unable to install or test due to geolocational restrictions I encountered on Google Play.

| Feature |  |

| Android App | Yes |

| Apple iOS App | Yes |

| Mobile Alerts – Basic Fields | Yes |

| Watchlists – Total Fields | 7 |

| Watchlist Syncing | No |

| Charting – Indicators / Studies (Total) | 30 |

| Charting – Drawing Tools (Total) | 15 |

Other trading platforms

OctaFX is primarily a MetaTrader broker, offering MetaQuotes Software Corporation’s suite of platforms that include MetaTrader 4 (MT4) and MetaTrader 5 (MT5).

Copy trading: OctaFX offers a web interface for copy trading (providers are known as Masters) that connects to its MetaTrader 4 (MT4) platform offering. OctaFX’s copy trading offering has grown, and I found that it merits inclusion alongside the best copy trading brokers – though it still has room to improve.

From over 6,201 systems available on OctaFX’s Copytrading app, 2,432 were found to either break even or achieve profitability in the last three months – about 39% of all strategies. I found the layout useful, although I would like to see more performance statistics that would help traders differentiate from among the Masters (providers of each strategy).

| Feature |  |

| Virtual Trading (Demo) | Yes |

| Proprietary Platform | Yes |

| Desktop Platform (Windows) | Yes |

| Web Platform | Yes |

| Social Trading / Copy Trading | Yes |

| MetaTrader 4 (MT4) | Yes |

| MetaTrader 5 (MT5) | Yes |

Market research

OctaFX’s market research is well organized and varied in its content. Rather than specializing in any one field, OctaFX provides a wide assortment of content types. However, when compared to research leaders IG, Saxo Bank, and CMC Markets, OctaFX has room to enhance its research offering.

Research overview: OctaFX’s research content lives in its Market Insights section, which features an economic calendar, daily analysis posts, as well as automated technical analysis by way of MetaTrader’s Autochartist plugin. My favorite features were the interest rates tracker, daily and weekly forecast articles, and the economic calendar – which was useful for keeping track of national holidays and global trading hours.

Market news and analysis: OctaFX produces daily articles that cover technical and fundamental analysis across popular trading symbols including forex and CFDs. It also offers its OC LiveTrader series, which consists of video content that is live-streamed on its YouTube channel. The quality of OctaFX’s research material is on par with what you’d typically find with the average broker, but lacks the rich content offered by the best brokers in this category.

| Feature |  |

| Daily Market Commentary | Yes |

| Forex News (Top-Tier Sources) | Yes |

| Autochartist | Yes |

| Trading Central (Recognia) | No |

| Social Sentiment – Currency Pairs | No |

Education

While OctaFX has improved its educational offering with webinars and live trading session recordings, its educational articles and videos suffer from a lack of variety.

Learning center: OctaFX’s website has a dedicated forex education section with roughly 20 articles for beginners. The OctaFX Youtube channel has archived webinars, and also hosts its Forex Basic Course video series that spans 11 parts.

Features like its trading glossary, platform tutorials, and dozens of Frequently Asked Questions (FAQs) help to flesh out OctaFX’s educational offering. That being said, there isn’t much educational content for learning how to trade or understand market dynamics. It’s worth mentioning that the broker does have a blog and a YouTube channel, yet I was still left wanting more.

Room for improvement: OctaFX’s educational offering would benefit from an overall expansion of its articles and videos, and an increase in the range of topics covered. Arranging the educational content by experience level would strengthen its ease-of-use, and balance the overall experience.

| Feature |  |

| Has Education – Forex or CFDs | Yes |

| Client Webinars | Yes |

| Client Webinars (Archived) | Yes |

| Videos – Beginner Trading Videos | Yes |

| Videos – Advanced Trading Videos | No |

| Investor Dictionary (Glossary) | Yes |

Final thoughts

OctaFX offers the full MetaTrader suite, albeit with a fairly limited offering of tradeable instruments. There’s no question – if OctaFX wants to compete with the best MetaTrader brokers, it needs to make improvements in its range of products and its research and education.

Though it has been granted regulatory status in Cyprus, OctaFX’s lack of additional reputable licenses heavily weighs down its Trust Score. Becoming regulated in more jurisdictions – especially tier-1 jurisdictions – will go a long way towards building trust with existing and prospective customers.

FAQ

Is OctaFX a good broker?

Is my money safe with OctaFX?

What is the minimum deposit for OctaFX?

Reviews

There are no reviews yet.