The Importance of Choosing a Regulated Forex Broker: A Case Study of RoboForex

Initial Deposit: $10

Visit SiteOverview

Trust score

Tradeable Symbols (Total):

Year Founded: 2009

Publicly Traded (Listed): Yes

Bank: Yes

Pros 👍🏻

- Availability of favorable trading conditions and a minimum deposit

- Unique investment program CopyFx

- Highest affiliate payments: from $5 per lot

- Market launch – STP and ECN

- Instant withdrawal of funds

Cons 👎🏻

- Minimum deposit – $10

- A small number of currency pairs – 36, for accounts: Pro, Pro-Cent, ECN, Prime

- Lack of cryptocurrency tools when trading on the R Trader platform

Overview of Roboforex

RoboForex is an online broker that provides access to trading in a wide range of financial instruments, including forex, stocks, commodities, and cryptocurrencies. In this review, we’ll focus on its forex trading offerings.

First and foremost, RoboForex offers a variety of account types to suit traders of all experience levels. This includes a demo account, which allows traders to practice trading without risking real money, and several live account options that offer different features and benefits. One standout feature is the ability to trade with multiple base currencies, which can help traders save on conversion fees.

Company Overview

RoboForex was founded in 2009 and is headquartered in Belize, with additional offices in Cyprus and Belarus. The broker provides access to trading in a wide range of financial instruments, including forex, stocks, cryptocurrencies, commodities, and more.

The company prides itself on its commitment to transparency and customer satisfaction, with a strong focus on providing educational resources and excellent customer support.

Regulation

RoboForex is regulated by multiple reputable regulatory bodies, which includes:

- International Financial Services Commission of Belize (IFSC): RoboForex (Belize) Ltd is authorized and regulated by the IFSC under license number IFSC/60/271/TS.

- Cyprus Securities and Exchange Commission (CySEC): RoboMarkets Ltd, which operates under the RoboForex brand in Cyprus, is authorized and regulated by the CySEC under license number 191/13.

- Belarusian National Bank (NBRB): RoboForex Ltd, which operates under the RoboForex brand in Belarus, is authorized and regulated by the NBRB under registration number 8.

- Financial Conduct Authority (FCA): RoboMarkets (UK) Ltd, which operates under the RoboForex brand in the UK, is authorized and regulated by the FCA under registration number 744480.

Being regulated by multiple reputable regulatory bodies means that RoboForex is held to high standards. When it comes to transparency, security, and customer protection. Traders can be confident that their funds are safe and that the broker operates in a fair and ethical manner.

Trading Platform

RoboForex offers two of the most popular trading platforms in the forex industry: MetaTrader 4 (MT4) and MetaTrader 5 (MT5). These platforms are available on desktop, mobile, and web versions, which allows traders to access their accounts from anywhere. Both platforms offer advanced charting tools, a wide range of technical indicators, and the ability to create and use custom indicators and automated trading strategies.

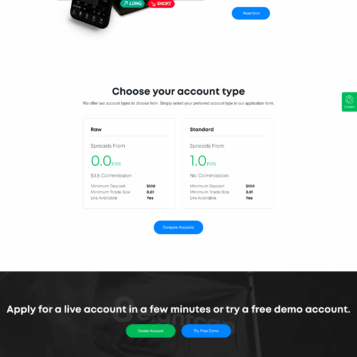

Account Types

RoboForex offers several different account types, which include:

- Pro-Cent Account: A popular account type for beginners, with low minimum deposits, and the ability to trade micro-lots.

- Pro-Standard Account: A standard account type that offers fixed and variable spreads, as well as access to all trading instruments offered by RoboForex.

- ECN Account: An account type that offers low spreads, market execution, and no re-quotes.

- Prime Account: An account type that offers institutional grade liquidity, no dealing desk intervention, and raw spreads from 0 pips.

- R Trader Account: A unique account type that offers access to over 12,000 trading instruments, including stocks, ETFs, and cryptocurrencies, all from a single platform.

- Demo Account: A free account type that allows traders to practice trading in a risk-free environment.

Fees and Commissions

One potential drawback to note is that RoboForex charges a commission on its Zero Spread account, which may not be ideal for traders who prefer a commission-free trading model.

RoboForex charges different fees and commissions for different account types. For example, the Pro-Cent and Pro-Standard accounts offer commission-free trading, but the ECN and Prime accounts charge a commission of $20 per million traded. The R Trader account offers commission-free trading for stocks and ETFs, but charges a commission of 0.015% for cryptocurrencies.

In terms of spreads, the Pro-Cent and Pro-Standard accounts offer fixed and variable spreads starting from 1.3 pips and 0.3 pips, respectively. The ECN and Prime accounts offer raw spreads from 0 pips, but charge a commission. The R Trader account offers spreads from 0 pips for forex, and spreads from 0.01 cents for stocks and ETFs.

Overall, the fees and commissions at RoboForex are competitive compared to other forex brokers. However, it’s important to note that the fees and commissions vary based on the account type and the instrument being traded. It’s always a good idea to carefully review the fee schedule before opening an account.

Deposit Methods

RoboForex supports a variety of deposit methods, including:

- Credit/debit card: Clients can make a deposit using Visa, Mastercard, and Maestro cards.

- Bank transfer: Clients can fund their accounts via bank wire transfer.

- E-wallets: RoboForex supports a wide range of e-wallets, including Skrill, Neteller, WebMoney, FasaPay, Perfect Money, and more.

- Cryptocurrencies: Clients can fund their accounts using popular cryptocurrencies such as Bitcoin, Ethereum, and Litecoin.

- Local payment methods: RoboForex supports local payment methods in various countries. Such as Sofort in Germany, iDeal in the Netherlands, and Boleto in Brazil.

Withdrawal Methods

Clients can withdraw funds from their RoboForex accounts using the same methods used for deposits. Withdrawal requests are processed within 24 hours, and there are no withdrawal fees charged by RoboForex. However, clients may be subject to fees charged by their payment providers or banks.

It’s important to note that the availability of certain deposit and withdrawal methods may depend on the country of residence of the client. Additionally, some methods may not be available for certain account types or currencies. It’s always a good idea to check the deposit and withdrawal options available in your location and for your account type before opening an account.

Customer Support Channels

RoboForex provides multiple channels for clients to get in touch with their customer support team, including:

- Live Chat: Clients can access live chat support 24/7 via the RoboForex website.

- Phone: Clients can call the customer support team via phone, with support available in multiple languages.

- Email: Clients can send an email to the customer support team and expect a prompt response.

- Social Media: RoboForex is active on social media platforms such as Facebook, Twitter, and YouTube, and clients can use these channels to get in touch with the customer support team.

- Knowledge Base: RoboForex provides a comprehensive knowledge base that covers a wide range of topics related to trading, account management, and more. Clients can access this resource at any time to find answers to common questions and learn more about the broker’s services.

Customer Support Quality

RoboForex has a reputation for providing high-quality customer support services. The broker’s customer support team is highly trained and experienced, and they are dedicated to providing fast and effective solutions to clients’ queries and issues. Clients can expect prompt and professional responses to their inquiries, regardless of the channel they use to get in touch with the support team.

In addition to providing direct support to clients. RoboForex also offers a range of educational resources, such as webinars, trading guides, and analysis tools. That can help traders improve their knowledge and skills. This further demonstrates the broker’s commitment to client satisfaction and support.

Education

RoboForex also provides a wide range of educational resources for traders, including webinars, video tutorials, and market analysis. Additionally, they offer a variety of deposit and withdrawal options, including credit cards, e-wallets, and bank transfers. Which makes it easy for traders to fund and withdraw from their accounts.

Conclusion

Overall, RoboForex is a solid choice for forex traders who are looking for a reputable broker with a wide range of trading options and educational resources. Their variety of account types and trading platforms, as well as their commitment to transparency and security. Make them a popular choice among traders of all levels.

Frequently asked questions (FAQs)

- Is RoboForex a regulated broker?

Yes, RoboForex is a regulated broker. It is regulated by the International Financial Services Commission (IFSC) in Belize and the Cyprus Securities and Exchange Commission (CySEC) in Cyprus.

- What trading platforms does RoboForex offer?

RoboForex offers multiple trading platforms, including MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader. These platforms are available for desktop, web, and mobile devices.

- What types of trading accounts does RoboForex offer?

RoboForex offers several types of trading accounts, including Cent accounts, Standard accounts, ECN accounts, and Prime accounts. Each account type has its own unique features and benefits.

4. What deposit and withdrawal methods does RoboForex support?

RoboForex supports a variety of deposit and withdrawal methods, including credit/debit cards, bank transfers, e-wallets, cryptocurrencies, and local payment methods.

Reviews

There are no reviews yet.