Overview

Trust score

Tradeable Symbols (Total): 1785

Year Founded: 2004

Publicly Traded (Listed): No

Bank: No

Trading 212 is not publicly traded and does not operate a bank. Trading 212 is authorized by one tier-1 regulator (high trust), one tier-2 regulator (average trust), and zero tier-3 regulators (low trust). Trading 212 is authorised by the following tier-1 regulator: Financial Conduct Authority (FCA). Learn more about Trust Score.

Trading 212 is considered average-risk, with an overall Trust Score of 77 out of 99.

Pros 👍🏻

- Intuitively designed, easy-to-use web trading platform and mobile app that earned Trading 212 a Best in Class spot for ease of use in our annual review.

- Diverse range of 1,785 symbols available for CFD and forex trading.

- Supports several exotic FX pairs, including 16 against the Bulgarian lev.

- Offers indemnity insurance over EUR 1,000,000 in excess of EUR 20,000 from Cypriot regulator.

Cons 👎🏻

- Outside of the economic calendar events, no news headlines are offered in mobile app.

- Besides sentiment data, research in the web platform is limited to snippet-like updates.

- Despite a large number of videos, Trading 212 has few written articles for education.

- MetaTrader is not available.

Offering of investments

Trading 212 offers traders CFDs on 29 commodities, 36 indices, 1536 shares, and 184 forex pairs, alongside access to exchange-traded securities such as fractional shares.

Cryptocurrency: Trading 212 no longer offers cryptocurrency trading.

| Feature |  |

| Forex Trading (Spot or CFDs) | Yes |

| Tradeable Symbols (Total) | 1785 |

| Forex Pairs (Total) | 184 |

| U.S. Stock Trading (Non CFD) | Yes |

| Int’l Stock Trading (Non CFD) | Yes |

| Social Trading / Copy Trading | No |

| Cryptocurrency (Physical) | No |

| Cryptocurrency (CFD) | No |

| Disclaimers | Note: Crypto CFDs are not available to retail traders from any broker’s U.K. entity, nor to U.K. residents (except to Professional clients). |

Commissions and fees

Trading 212 offers two accounts: Invest for trading shares, and CFD for trading CFDs. The minimum deposit for the Invest account is 1 euro, while the CFD account requires a 10 euro deposit. This review focuses on the CFD account. For more on the Invest account, read our U.K. StockBrokers.com review of Trading 212.

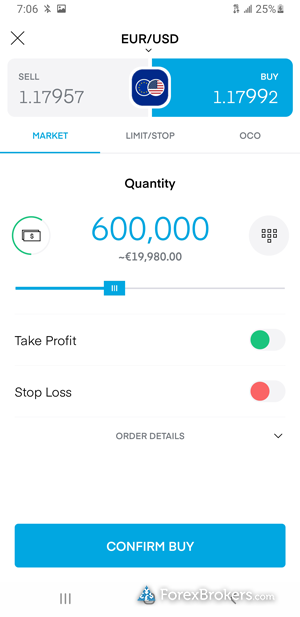

Trading 212 advertises zero-commission trading, but you’ll still need to pay a spread when trading CFDs and forex. Trading 212 does not publish an average spread, which would help to clarify its pricing for forex pairs such as the EUR/USD. This omission of average spread data puts it at a disadvantage, as I’ve come to expect this information from the best CFD and forex brokers.

| Feature |  |

| Minimum Initial Deposit | EUR 10 |

| Average Spread EUR/USD – Standard | N/A |

| All-in Cost EUR/USD – Active | N/A |

| Active Trader or VIP Discounts | No |

| Execution: Agency Broker | Yes |

| Execution: Market Maker | Yes |

Trading 212 Mobile trading apps

The Trading 212 app is undeniably popular, with over 10 million downloads on the Google Play store. The app integrates educational video content for beginners, but experienced traders will find the lack of advanced features to be disappointing – especially when compared to the best mobile trading apps.

Apps overview: Trading 212 offers an incredibly easy-to-use mobile app for Android and iOS devices. The default watch list screeners make it easy to sort through markets such as stocks, forex, indices, and newly added symbols.

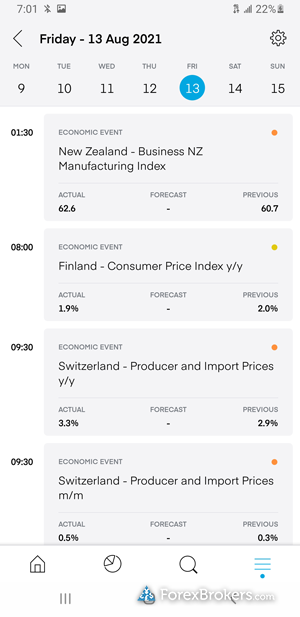

The biggest drawback I could find in the Trading 212 app is the lack of substantial research tools. It does have a robust economic calendar that conveniently highlights upcoming events for any given symbol.

Ease of use: Trading 212 is the first broker I have reviewed that also has its own Google chrome plugin, which provides quick access to the platform from within the browser. It’s also worth noting that its watchlists are customizable and automatically sync with the web platform. These features helped earn Trading 212 a Best in Class ranking (top 7) for Ease of Use in our annual review.

Charting: There are 45 indicators and 19 drawing tools that have been cleanly integrated into the app’s charting tool. The mobile app has near-identical functionality to the corresponding web version.

Trading tools: Unfortunately, good-till-date order expirations are not currently available and instead default to good-till-cancel. These kinds of subtle details illustrate how much room there is for the app to improve its customization options.

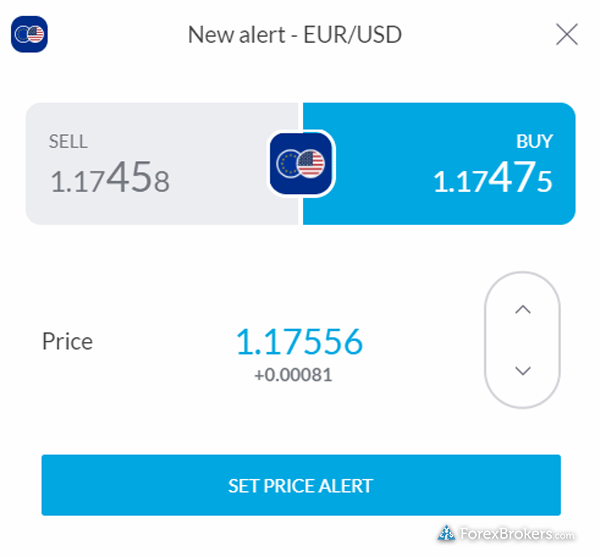

Upcoming events: One feature that stands out in the Trading 212 mobile app experience is the ability to see upcoming events when you are looking at the symbol properties of a particular instrument such as the EUR/USD. The event is displayed along with its potential impact, expected forecast, and exact time. One thing I would note: It would be nice if you could subscribe to and receive alerts about any given event – a functionality I’ve observed on CMC Markets’ trading platform.

| Feature |  |

| Android App | Yes |

| Apple iOS App | Yes |

| Mobile Alerts – Basic Fields | Yes |

| Watchlists – Total Fields | 5 |

| Watchlist Syncing | Yes |

| Charting – Indicators / Studies (Total) | 45 |

| Charting – Drawing Tools (Total) | 19 |

Other trading platforms

Platforms overview: Trading 212 offers a web-based trading platform, as part of its multi-asset offering. As with its other platforms, you’ll gain access to both of its accounts – CFD and Invest – and their respective markets. Most of the platform’s features are easy to use and it boasts a clean, simplified layout that includes robust charts and integrated news headlines.

One useful feature that Trading 212 shares with eToro: the website will cache a user’s credentials locally, so that they are automatically logged in when they access the platform via their browser.

Charting: Trading 212’s web platform – like the mobile app – features solid charting. You can choose from five different types, and you’ll gain access to 45 indicators alongside 19 drawing tools. You can create and save your own chart templates – a feature which I’ve found helpful when applying settings across a variety of charts. One noteworthy – albeit small – limitation: you can open multiple charts and switch between them, but you cannot detach the chart from the platform.

Trading tools: The web platform is missing the mobile app’s useful tool that allows you to discover upcoming events simply by glancing at the symbol of a given instrument. Rather, you have to do it the old-fashioned way and manually open the economic calendar to view those events.

| Feature |  |

| Virtual Trading (Demo) | Yes |

| Proprietary Platform | Yes |

| Desktop Platform (Windows) | No |

| Web Platform | Yes |

| Social Trading / Copy Trading | No |

| MetaTrader 4 (MT4) | No |

| MetaTrader 5 (MT5) | No |

| DupliTrade | No |

| ZuluTrade | No |

| Charting – Indicators / Studies (Total) | 45 |

| Charting – Drawing Tools (Total) | 19 |

| Charting – Trade From Chart | Yes |

| Watchlists – Total Fields | 5 |

Trading 212 Market research

Trading 212 does not have a particularly strong research offering; it provides just a touch more than what I’d consider the bare minimum. Users gain access to news headlines and analysis, a hotlist of popular trading symbols, and a genuinely useful economic calendar.

Research overview: Trading 212 provides daily market analysis across a range of instruments, from within its web trading platform. However, research material is sparse, and the research that is available appears to simply be out of date. For example, the last video uploaded to its YouTube channel was more than a year before the time we conducted testing (August 2021).

Market news and analysis: Trading 212’s web platform provides news briefs and nearly a dozen technical analysis snippets, complete with price references for popular CFD markets like forex, commodities and metals.

| Feature |  |

| Daily Market Commentary | Yes |

| Forex News (Top-Tier Sources) | Yes |

| Autochartist | No |

| Trading Central (Recognia) | No |

| Social Sentiment – Currency Pairs | No |

Trading 212 Education

Trading 212 has a good variety of educational videos, with over 170 available on its YouTube channel. Detailed articles and advanced materials are limited to the help center, however, and there are no archived webinars.

Learning center: Education at Trading 212 consists mostly of videos, many of which are embedded in its web and mobile platform. Besides some posts in its community forum and FAQs in its help section, Trading 212 does not offer educational articles.

Room for improvement: Trading 212 would benefit from the addition of educational features I’ve found on the best brokers’ platforms, such as articles organized by experience level, and quizzes for evaluating and tracking your progress.

| Feature |  |

| Has Education – Forex or CFDs | No |

| Client Webinars | No |

| Client Webinars (Archived) | No |

| Videos – Beginner Trading Videos | Yes |

| Videos – Advanced Trading Videos | Yes |

| Investor Dictionary (Glossary) | Yes |

Final thoughts

Trading 212 has done an excellent job of simplifying its platform to make the customer experience seamless for beginners.

However, its research offerings lack depth across its site, web and mobile app. More experienced traders may be left wanting more from Trading 212, compared to the best forex and CFD brokers.

About Trading 212

Founded in 2004, the Trading 212 brand is regulated in the U.K. by the Financial Conduct Authority (FCA), in Cyprus by the Cyprus Securities and Exchange Commission (CySEC), and in Bulgaria by the Financial Supervision Commission (FSC). Trading 212 holds over EUR 3.5 billion in customer assets and over 1.5 million clients.

2022 Review Methodology

For our 2022 Forex Broker Review we assessed, rated, and ranked 39 international forex brokers over a three-month time period resulting in over 50,000 words of published research.

Each broker was graded on 113 different variables, including our proprietary Trust Score algorithm. This innovative scoring system ranks the level of trustworthiness for each broker based on factors such as licenses, regulation and corporate structure. Read about Trust Score here.

As part of our annual review process, all brokers had the opportunity to provide updates and key milestones and complete an in-depth data profile, which we hand-checked for accuracy.

Ultimately, our rigorous data validation process yields an error rate of less than .1% each year, providing site visitors with quality data they can trust. Learn more about how we test.

Forex Risk Disclaimer

There is a very high degree of risk involved in trading securities. With respect to margin-based foreign exchange trading, off-exchange derivatives, and cryptocurrencies, there is considerable exposure to risk, including but not limited to, leverage, creditworthiness, limited regulatory protection and market volatility that may substantially affect the price, or liquidity of a currency or related instrument. It should not be assumed that the methods, techniques, or indicators presented in these products will be profitable, or that they will not result in losses. Read more on forex trading risks.

Reviews

There are no reviews yet.