Overview

Trust score

Tradeable Symbols (Total): 168

Year Founded: 2016

Publicly Traded (Listed): No

Bank: No

VT Markets is not publicly traded, does not operate a bank, and is authorised by two tier-1 regulators (high trust), zero tier-2 regulators (average trust), and one tier-3 regulator (low trust). VT Markets is authorised by the following tier-1 regulators via its parent company, Vantage: Australian Securities & Investment Commission (ASIC) and the Financial Conduct Authority (FCA). Learn more about Trust Score.

VT Markets is considered average-risk, with an overall Trust Score of 83 out of 99.

Pros 👍🏻

- VT Markets holds regulatory status in one tier-3 jurisdiction and is part of Vantage Group, which holds licenses in two tier-1 jurisdictions.

- VT Markets offers the full MetaTrader suite, along with premium trading tools from Trading Central.

- Trading costs at VT Markets range from average (when using the VT Markets ECN account) to expensive (for the Standard account option).

- VT Pro – the broker’s proprietary mobile app – is easy to use and delivers news headlines and research.

- VT Markets carries indemnity insurance to complement its existing regulatory protection.

- Support for third-party features like trading signals from Acceage and copy trading via ZuluTrade.

Cons 👎🏻

- Fewer than 200 symbols are available at VT Markets, compared to the extensive selection of markets to trade at Saxo Bank, IG, or CMC Markets.

- VT Markets offers a growing but still-limited array of educational content, putting it at a disadvantage relative to peers.

- Access to Trading Central tools requires a minimum deposit of $500.

Offering of investments

VT Markets’ offering of CFDs includes 168 symbols and spans a variety of asset classes, such as shares, commodities, metals, indices, and forex pairs. The following table summarizes the different investment products available to VT Markets clients.

| Feature |  |

| Forex Trading (Spot or CFDs) | Yes |

| Tradeable Symbols (Total) | 168 |

| Forex Pairs (Total) | 39 |

| U.S. Stock Trading (Non CFD) | No |

| Int’l Stock Trading (Non CFD) | No |

| Social Trading / Copy Trading | Yes |

| Cryptocurrency (Physical) | No |

| Cryptocurrency (CFD) | Yes |

| Disclaimers | Note: Crypto CFDs are not available to retail traders from any broker’s U.K. entity, nor to U.K. residents (except to Professional clients). |

Commissions and fees

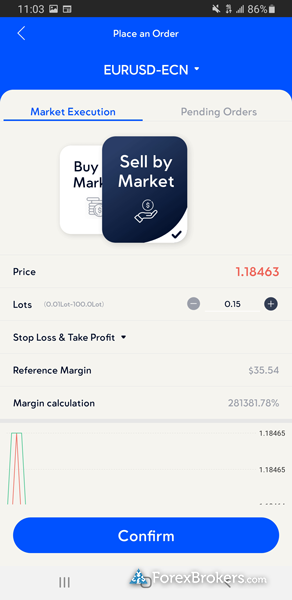

The cost of trading at VT Markets varies depending on whether you choose the Raw ECN or the Standard STP account. The Standard STP account is commission-free but comes with spreads higher than those for the Raw ECN account, and both accounts require a minimum deposit of just $200.

Average spreads: VT Markets lists the typical spread on the EUR/USD at 1.2 pips for its Standard STP account, while the RAW ECN effective spread was 0.83 pips (based on 0.6 round turn commission and 0.23 average spread for September 2021). The pricing for the VT Markets Raw ECN account is pretty standard for the industry, while the Standard STP account pricing is less attractive.

| Feature |  |

| Minimum Initial Deposit | $200 |

| Average Spread EUR/USD – Standard | 1.2 (September 2021) |

| All-in Cost EUR/USD – Active | 0.8 (September 2021) |

| Active Trader or VIP Discounts | No |

| Execution: Agency Broker | No |

| Execution: Market Maker | Yes |

Mobile trading apps

Despite full support for the MetaTrader suite and a proprietary mobile app, VT Markets just can’t compete with what the best MetaTrader brokers offer in this category. VT Markets’ VT Pro mobile app has shown real promise, but will need to show more progress to realize its full potential.

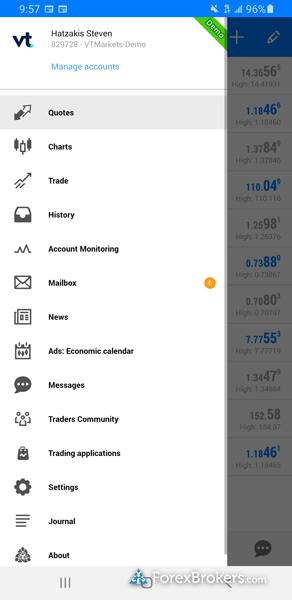

Apps overview: VT Markets is primarily a MetaTrader broker, but also offers a proprietary mobile app called VT Pro. VT Pro, MetaTrader 4 (MT4), and MetaTrader 5 (MT5) are all available for Android and Apple iOS devices directly from the Google Play and Apple App stores.

Ease of use: VT Markets’ VT Pro mobile app has a well-designed layout that is easy to swipe through, and includes cleanly-integrated research content. It features useful tools like watchlist items, and resources like its newsletter articles that cover Pivot Point analysis across a set of six popular trading symbols.

In addition, there is a dedicated news tab with articles covering technical analysis, and a full economic calendar that lets you subscribe to events (as well as a useful function that populates calendar events when you view a particular symbol).

Charting: Charting on VT Pro offers just a small range of rudimentary features, such as the ability to rotate the display into landscape mode and the inclusion of tick chart functionality. There are only seven indicators available, ten selectable time frames, and no drawing tools or advanced features.

| Feature |  |

| Android App | Yes |

| Apple iOS App | Yes |

| Mobile Alerts – Basic Fields | Yes |

| Watchlists – Total Fields | 7 |

| Watchlist Syncing | No |

| Charting – Indicators / Studies (Total) | 15 |

| Charting – Drawing Tools (Total) | 30 |

| Mobile Charting – Draw Trendlines | Yes |

| Charting – Multiple Time Frames | No |

| Forex Calendar | Yes |

Other trading platforms

With no proprietary web or desktop platform, VT Markets remains a MetaTrader-only broker offering the popular platform suite developed by MetaQuotes Software Corporation. For the top picks among similar offerings, check our best MetaTrader brokers list.

Platforms overview: VT Markets offers the MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms, available for Windows and Mac. For traders that deposit at least $500, VT Markets offers several plugins for MT4 as part of the Pro Trading Tools suite from Trading Central (a popular third-party provider).

Trading tools: VT Markets supports third-party signal providers for copy trading, such as Acceage and ZuluTrade.

| Feature |  |

| Virtual Trading (Demo) | Yes |

| Proprietary Platform | No |

| Desktop Platform (Windows) | Yes |

| Web Platform | Yes |

| Social Trading / Copy Trading | Yes |

| MetaTrader 4 (MT4) | Yes |

| MetaTrader 5 (MT5) | Yes |

| DupliTrade | No |

| ZuluTrade | Yes |

| Charting – Indicators / Studies (Total) | 15 |

| Charting – Drawing Tools (Total) | 30 |

| Charting – Trade From Chart | Yes |

| Watchlists – Total Fields | 7 |

Market research

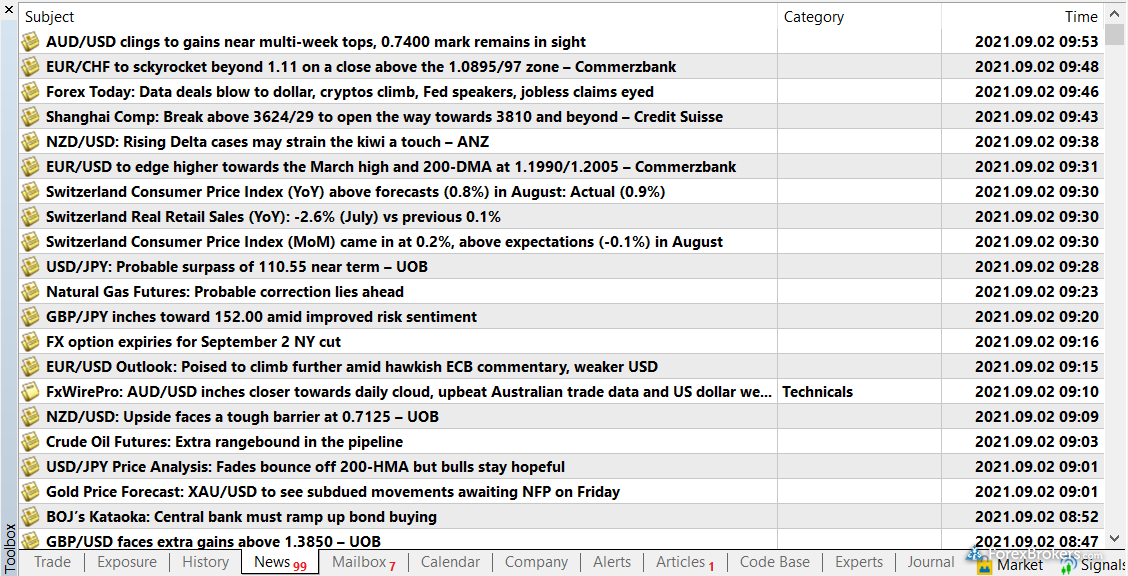

VT Markets provides a small selection of research content in the form of its Daily Market Analysis series, alongside third-party content available from Trading Central. Though the quality is good, the Daily Market Analysis series is a rather limited offering that provides just one daily article. VT Markets ranks close to the industry standard in this category, but has a long way to go if it wants to truly compete with industry leaders like Saxo Bank, IG, or CMC Markets.

Research overview: I found the quality of in-house coverage in VT Markets’ Daily Market Analysis series to be decent. The series covers fundamental and technical analysis and includes multiple descriptive charts, but I was left wanting to know more about the condition of the broader markets. Trading Central’s Economic Calendar and the daily video updates posted on VT Markets’ YouTube channel do help to round out its research. VT Markets could boost its research offering by organizing and expanding the range of its video content.

Market news and analysis: For clients who deposit over $500, VT Markets provides access to the Pro Trading Tools suite from Trading Central, available directly through the client portal. An add-on for MetaTrader is also available from Trading Central as part of VT Markets offering. Otherwise, market news and analysis is limited to just one daily article and video published by VT Markets.

| Feature |  |

| Daily Market Commentary | Yes |

| Forex News (Top-Tier Sources) | Yes |

| Autochartist | No |

| Trading Central (Recognia) | Yes |

| Social Sentiment – Currency Pairs | No |

Education

VT Markets recently introduced an education section on its website, with nearly a dozen videos and articles. There is also related financial markets educational content on its YouTube channel. Besides some content from Trading Central, VT Markets offers a limited selection of educational materials, which weighs down on its ranking in this category. For comparison, see education leaders like Saxo Bank, IG, or FXCM.

| Feature |  |

| Has Education – Forex or CFDs | Yes |

| Client Webinars | No |

| Client Webinars (Archived) | No |

| Videos – Beginner Trading Videos | Yes |

| Videos – Advanced Trading Videos | No |

| Investor Dictionary (Glossary) | Yes |

Final thoughts

VT Markets needs to significantly enhance its offering of financial markets education (which is currently absent altogether) and its research, and make improvements to its mobile app if it wants to compete with the best forex brokers.

What’s more, its range of markets is limited compared to the thousands of symbols available from other multi-asset brokers that offer MetaTrader, such as City Index, XTB, or FOREX.com.

About VT Markets

Headquartered in Sydney, Australia, VT Markets was founded in 2016 and is a subsidiary of Vantage International Group (VIG), which holds regulatory status in various jurisdictions, including Cayman Islands, the U.K. and Australia (see our Vantage review to learn more).

2022 Review Methodology

For our 2022 Forex Broker Review we assessed, rated, and ranked 39 international forex brokers over a three-month time period resulting in over 50,000 words of published research.

Each broker was graded on 113 different variables, including our proprietary Trust Score algorithm. This innovative scoring system ranks the level of trustworthiness for each broker based on factors such as licenses, regulation and corporate structure. Read about Trust Score here.

As part of our annual review process, all brokers had the opportunity to provide updates and key milestones and complete an in-depth data profile, which we hand-checked for accuracy.

Ultimately, our rigorous data validation process yields an error rate of less than .1% each year, providing site visitors with quality data they can trust. Learn more about how we test.

Forex Risk Disclaimer

There is a very high degree of risk involved in trading securities. With respect to margin-based foreign exchange trading, off-exchange derivatives, and cryptocurrencies, there is considerable exposure to risk, including but not limited to, leverage, creditworthiness, limited regulatory protection and market volatility that may substantially affect the price, or liquidity of a currency or related instrument. It should not be assumed that the methods, techniques, or indicators presented in these products will be profitable, or that they will not result in losses. Read more on forex trading risks.

Reviews

There are no reviews yet.