Overview

Trust score

Tradeable Symbols (Total): 1372

Year Founded: 2009

Publicly Traded (Listed): No

Bank: No

XM Group is not publicly traded, does not operate a bank, and is authorised by two tier-1 regulators (high trust), two tier-2 regulators (average trust), and one tier-3 regulator (low trust). XM Group is authorised by the following tier-1 regulators: Australian Securities & Investment Commission (ASIC) and the Financial Conduct Authority (FCA). Learn more about Trust Score.

XM Group is considered average-risk, with an overall Trust Score of 90 out of 99.

Pros 👍🏻

- Offers 1,230 CFDs, including 57 forex pairs.

- Autochartist and Trading Central complement in-house research offering.

- The XM Shares account requires a $10,000 deposit if you want exchange-traded securities (non-CFD).

- Excellent research content that includes daily videos, podcasts, and organized articles.

- In-house broadcasting features TV-quality video content, and live recordings.

- A comprehensive selection of educational webinars, articles, and Tradepedia courses.

- Offers full MetaTrader suite — which features signals market for copy trading, along with Analyzzer algorithm.

Cons 👎🏻

- Standard account spreads are expensive compared to industry leaders.

- Average spreads are not published for the commission-based XM Zero account.

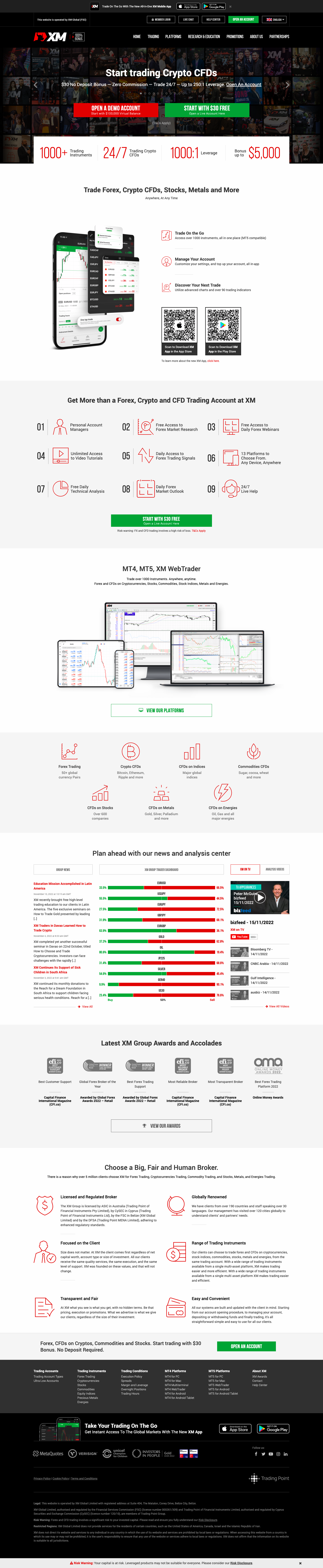

About XM

With over 5,000,000 clients since its founding in 2009, XM has grown into a large and robust international investment company and a true market leader.

Currently XM has 600 professionals with many years of experience in the financial industry.

With its long experience and the ability to support more than 30 languages, XM is the right broker for traders of any level and anywhere. We have the expertise and resources to help you realize your investment goals, something only a large broker can do.

Company Overview

XM.com was founded in 2009. Today, it is a market maker boasting over five million clients in over 190 countries and 30+ industry awards. 1000+ assets are available with spreads starting from 0.0 pip.

The company has grown into an established international investment firm, priding itself on providing a personalized experience for every client, no matter their investment goals. The broker’s headquarters are based in Limassol, Cyprus.

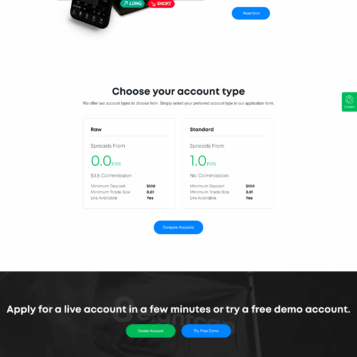

XM Spreads and Commissions

XM implements a strict “no hidden fees or commissions” policy. Therefore, the commission only applies to the XM Zero account at $7.

The commissions paid to XM are among the lowest in the market.

Fixed or variable spread?

XM offers variable spreads, similar to the interbank forex market. Since fixed spreads are usually higher than variable spreads, in case you trade with fixed spreads, you will have to pay a premium.

Forex brokers that offer fixed spreads often impose trading restrictions during news releases – and this makes your insurance worthless. XM does not impose any restrictions on trading during the news release period.

Fees

The following is an overview of XM fees:

| Assets | Fee Level | Fee Terms |

|---|---|---|

| EURUSD | Low | The fees are built into the spread with Standard, Micro, and Ultra-Low accounts. The average spread cost for the Standard account is 1.7 pips during peak trading hours. There is a small spread cost and a $3.5 commission per lot per trade with XM Zero accounts. |

| US Stock Fee | Average | 0.04% with a $1 minimum. Only available for clients onboarded under IFSC. |

| Inactivity Fee | Low | The broker charges a $15 one-off maintenance fee after one year of inactivity. If the account remains inactive you will have to pay a $5 per month fee. |

| Europe 50 CFD | Low | During peak trading hours 2.6 points are the average spread cost, the fees are built into the spread, however. |

| S&P 500 CFD | Low | The fees are built into the spread, 0.7 is the average spread cost during peak trading hours. |

Deposit and Withdrawal Methods

XM.com deposit and withdrawal methods for traders are Credit card, Debit card, Neteller, Skrill, UnionPay, Web money, and Bank Wire. XM withdrawal options for XM partners are Skrill, Neteller, Sticpay and Bank Wire.

Deposit methods are:

- VISA

- VISA Electron

- Mastercard

- Maestro

- Diners Club International

- UnionPay

- XM Card

- Skrill

- Neteller

- Web Money

- Bank Wire

- Sticpay

Leverage

XM provides with maximum 1:1,000 leverage and it has an appeal to the investors. Wide range of 1:1 to 1:1,000 leverage is freely available from the beginning of real account opening (*1). The most attractive feature of FX trading is the leverage where you can trade in a big size amount with the minimal amount of margin. You can trade not only FX currency pairs but also popular gold with maximum 1:1,000 leverage with XM.

There would be no fluctuation of leverage or margin ratio with XM at the time of economic indicator release or during hours of low liquidity such as night time or weekends with XM.

Is XM safe or a scam ?

Yes definitely. XM is one of the best forex service providers. XM Group has a low minimum deposit, good customer service, an excellent web & mobile trading platform, low fees, great educational tools, and an easy account opening process. So based on these features, we can say that XM is suitable for beginners.

Is XM broker safe to use?

As per our analysis, each day, clients lost their money to scammers from unregulated services. But XM forex online broker has top-tier regulators. So we can say that traders can go with this FX broker. XM is a safe and trusted broker.

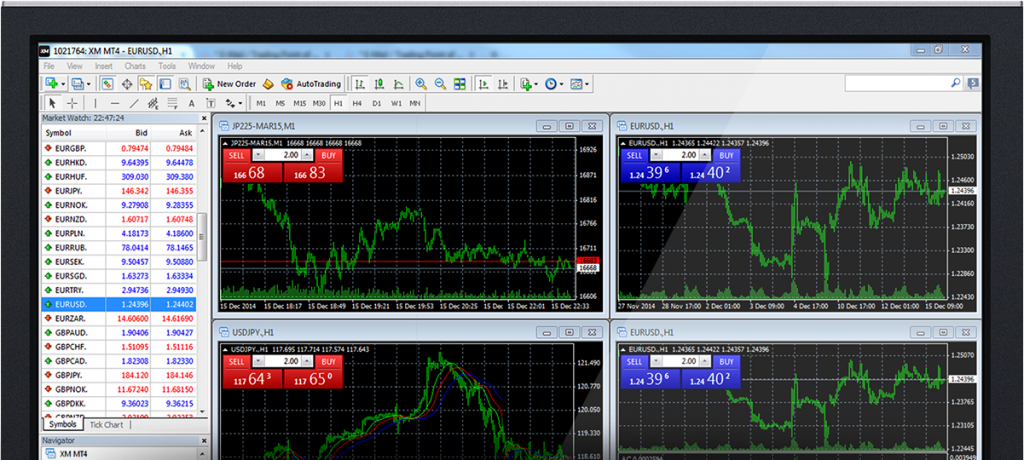

Trading Flatform

MetaTrader 4

The multi-award winning MetaTrader 4 is a popular choice amongst retail forex traders. Its tools are easy to use, efficient and support customization.

Key features include:

- Three chart types

- One-click trading

- VPS functionality

- Micro lot accounts

- 50+ technical indicators

- Three execution modes

- Two market orders

- Four pending orders

- Two stop orders and a trailing stop

- Full Expert Advisor (EA) functionality

The margin call level on MT4 is 20%.

MetaTrade 5

Next in the series is MetaTrader 5, the advanced multi-asset trading platform developed for institutions. Large trading companies use this multi-functional trading platform to run their stock and commodities trading. It is not as forex market-centric as MetaTrader 5; however, there are a few factors common between the two platforms. MetaTrader 5 is available on the web, desktop, and mobile app versions. It is easy to navigate and has all the features provided by MetaTrader 5. In addition to those, the trading platform has built-in trading robots and an open-source database of trade strategies.

Education

The XM provides a wide range of high-quality educational material that competes with industry titans like IG, Saxo Bank, and FXCM.

For example, Tradepedia, the company’s in-house video course, is an excellent collection to reference for newcomers. It delivers educational Forex and CFD material. With 39 videos spread throughout 7 chapters and high-quality coverage for both beginner and advanced videos, the series is undoubtedly helpful. The course instructor shows how to use some of the company’s own indicators, like the Avramis River indicator.

There are a total of 53 written articles grouped in a progressive fashion throughout 6 chapters, covering 13 lessons in forex, beginning with the fundamentals and progressing to more advanced topics.

Plus, XM offers comprehensive coverage of time zones and a detailed timetable arranged by experience level for clients to subscribe to, with 49 webinar instructors who cover 19 languages every week.

Customer Support

Customer service at XM is fast and reliable. Support is available in a wide range of languages, with native speakers providing assistance to clients in over 25 languages.

Support representatives speaks: English, Japanese, Chinese, Greek, Bahasa Malay, Bahasa Indonesia, French, Spanish, Italian, Hungarian, Russian, Dutch, German, Polish, Portuguese, Czech, Slovakian, Bulgarian, Hindi, Arabic, Korean, and Romanian. You can reach out to representatives in several departments across the globe.

You can contact XM by:

- Phone

- Live Chat

Support is available 24/5 via live chat, email, and phone, during the same time period as when the markets are open.

We found their response time is quick and representatives provide relevant answers. Live chat response was quick, phone support was great and we got the answers to our questions. We received replies to our email withing one business day.

Phone number: +501 223-6696

Email: support@xm.com

Final Thought

With XM Review, it is a well-regulated broker with numerous highly respected licenses that delivers truly transparent conditions and is an extremely customer-friendly broker. No re-requotes and no hidden fees or commissions policy, as well Negative balance protection definitely a plus. So all in all, we had very comfortable as well the good real-time market execution, making XM very welcomed among trading offerings and suitable for various type of traders, including beginners.

FAQ’s

What is the maximum number of pending orders?

The maximum number of pending orders on the XM exchange (XM Golbal) depends on the type of trading account you choose. With a Share account, there are 50-100 orders, 200 orders for the remaining accounts.

Is XM regulated by any company?

ASIC in Australia; by CySEC in Cyprus; by FSC in Belize (XM Global Limited).

What are the trading hours at XM?

Similar to other exchanges, trading hours will be from 22:05 GMT on Sunday until 21:50 GMT on Friday. If you access the software when the trading hours expire, the transaction will not be possible and the function of the exchange is always for observation purposes only.

What is the leverage of shares traded on XM?

The leverage of shares traded on XM is very flexible, from 1:1 to 888:1. This level of leverage is suitable for the needs of both “ newbie ” and professional traders.

Reviews

There are no reviews yet.