Overview

Trust score

Tradeable Symbols (Total): 12000

Year Founded: 2002

Publicly Traded (Listed): Yes

Bank: No

XTB is considered low-risk, with an overall Trust Score of 95 out of 99. XTB is a publicly traded company that is authorised by one tier-1 regulator (high trust), three tier-2 regulator (average trust), and one tier-3 regulator (low trust). XTB is authorised by the following tier-1 regulator: Financial Conduct Authority (FCA). Learn more about Trust Score.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 81% of retail CFD accounts lose money. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

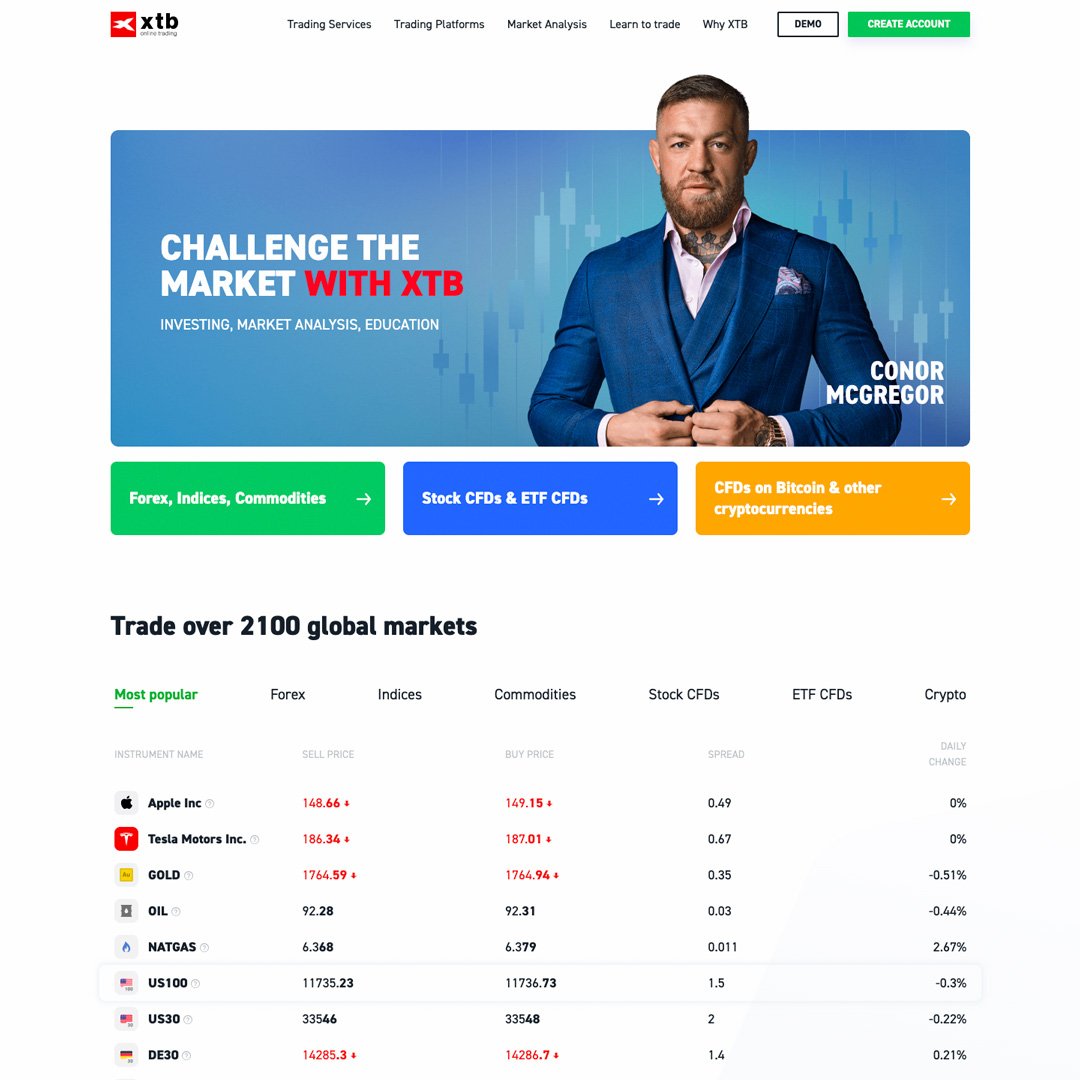

As a trusted multi-asset broker, XTB offers outstanding customer service, a wide variety of forex and CFDs, and an excellent overall trading experience. Its xStation 5 trading platform is well-designed and packed with innovative features, and XTB’s comprehensive educational content and research helped the broker finish Best in Class for Research in 2022.

Pros 👍🏻

- Founded in 2002, XTB is publicly traded and regulated in one tier-1 jurisdiction, making it a safe broker (low-risk) for trading forex and CFDs.

- XTB’s xStation platform suite provides excellent usability alongside a robust selection of trading tools and features.

- XTB offers an excellent variety of extensive educational videos and written content, and over 200 lessons via its Trading Academy.

- XTB U.K. recently launched zero-dollar commissions for share CFDs.

Cons 👎🏻

- Aside from its weekly webinars, XTB does not provide daily video updates in English (but does so in other languages).

- MetaTrader 4 (MT4) is no longer promoted at XTB’s U.K., Poland, and Cyprus branches – though it can be requested manually from select global XTB offices.

- Custom investment basket tool has been temporarily discontinued from xStation 5 platform.

- Cash equities are only available in the EU via XTB’s Polish branch.

Offering of investments

XTB provides traders access to CFDs on 1,848 stocks, 135 ETFs, 22 commodities, 36 indices, 5 cryptocurrencies, and 57 forex pairs. XTB also provides nearly 7,800 cash equities (non-leveraged)and 150 ETFs as part of its securities offering (though these are not available from its U.K. or Cyprus branches). The following table summarizes the different investment products available to XTB clients.

Cryptocurrency: Cryptocurrency trading is available at XTB through CFDs and through trading the underlying asset (e.g. buying Bitcoin). Note: Crypto CFDs are not available to retail traders from any broker’s U.K. entity, nor to U.K. residents (except for professional clients).

| Feature |  |

| Forex Trading (Spot or CFDs) | Yes |

| Tradeable Symbols (Total) | 12000 |

| Forex Pairs (Total) | 49 |

| U.S. Stock Trading (Non CFD) | Yes |

| Int’l Stock Trading (Non CFD) | Yes |

| Social Trading / Copy Trading | Yes |

| Cryptocurrency (Physical) | No |

| Cryptocurrency (CFD) | Yes |

| Disclaimers | Note: Crypto CFDs are not available to retail traders from any broker’s U.K. entity, nor to U.K. residents (except to Professional clients). |

Commissions and fees

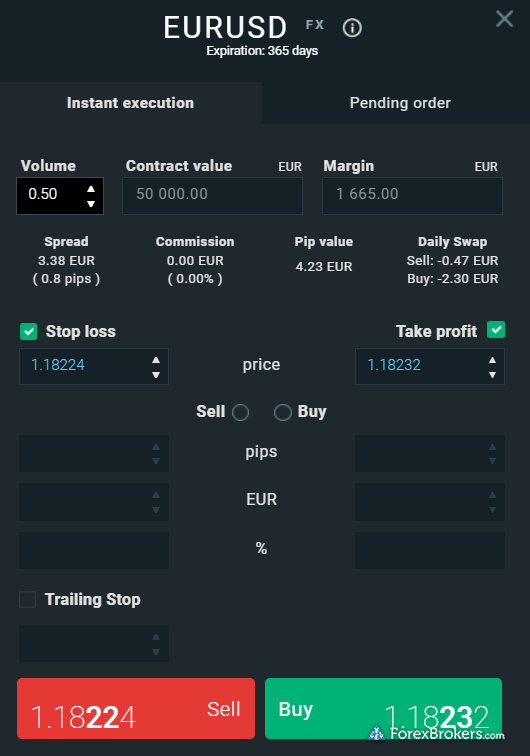

XTB offers two account types; there’s a spread-only Standard account, and a commission-based Professional account – though this option is reserved for clients who meet the definition of elected Professionals in the U.K. and Europe. Overall, pricing at XTB is in line with the industry average but trails the best brokers in this category.

Average spreads: Using data from Q3 2021, XTB average spreads on the EUR/USD stood at 0.91 (note: the commission-based pro account is being phased out and is no longer promoted).

Standard vs. Pro accounts: XTB’s Standard and Professional accounts have similar pricing when trading at higher volumes – and minimum deposits start at 250 base currency (£250, €250, or $250). For smaller amounts, however, the Standard account appears to be cheaper. My choice for retail traders would be the Standard account, especially as the Pro account is no longer available in most regions – except for certain legacy clients.

Active trader discounts: For active traders (and those in the EU who meet the definition of elective professionals), XTB will rebate a portion of the spread (from 5% to 30%) back to you when you reach certain volume thresholds, starting from 20 lots per month to as much as 1000 lots for the full 30% discount. This active trader program is known as XTB’s Lower Spread Group, and helps the company compete with similar offerings from FXCM, FOREX.com, and CMC Markets.

| Feature |  |

| Minimum Initial Deposit | $0 |

| Average Spread EUR/USD – Standard | 1.07 (Q3 2022) |

| All-in Cost EUR/USD – Active | 1.04 (Q3 2022) |

| Active Trader or VIP Discounts | Yes |

| Execution: Agency Broker | Yes |

| Execution: Market Maker | Yes |

Mobile trading apps

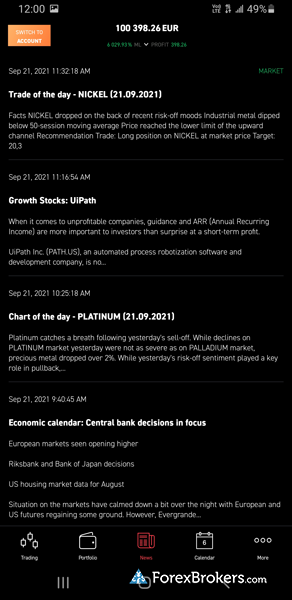

While the MetaTrader 4 mobile app is available in certain locations, XTB’s proprietary xStation 5 mobile app is far superior and available everywhere. There’s no question; XTB’s mobile app can compete with the best forex brokers.

xStation mobile features: The xStation 5 app is cleanly designed with several features that mirror its web counterpart, such as streaming news, predefined watchlists, an economic calendar, top movers, and client sentiment data. Several integrated videos in the mobile app also provide webinar-style educational content, with multiple videos that are over an hour long.

xStation charting: xStation 5 charts are good, but not great; I was disappointed to find that watchlists do not sync with the web version of the platform, and that there are only half as many indicators (13 total). Nice features in xStation 5 mobile charts include an automatic-save feature for your trend lines and drawings, and the ability to easily add indicators to your charts while zooming in on various time frames.

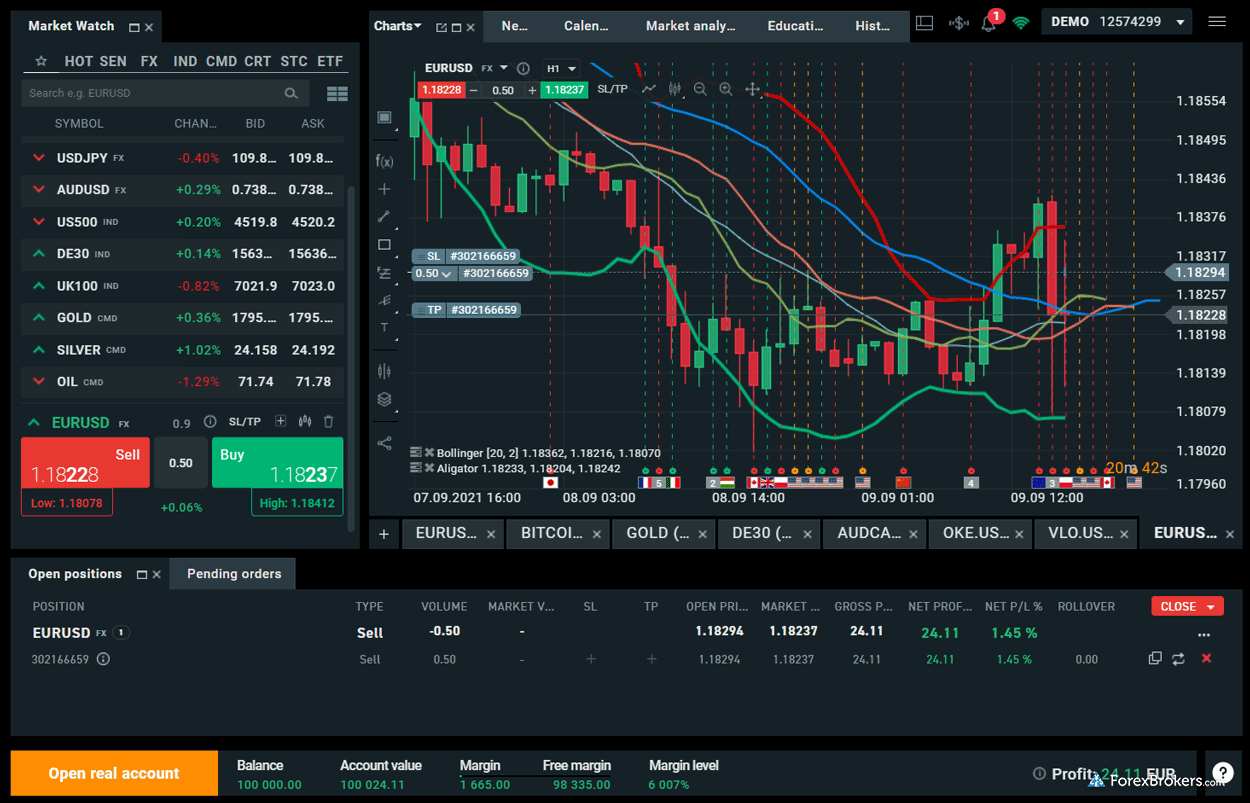

Other trading platforms

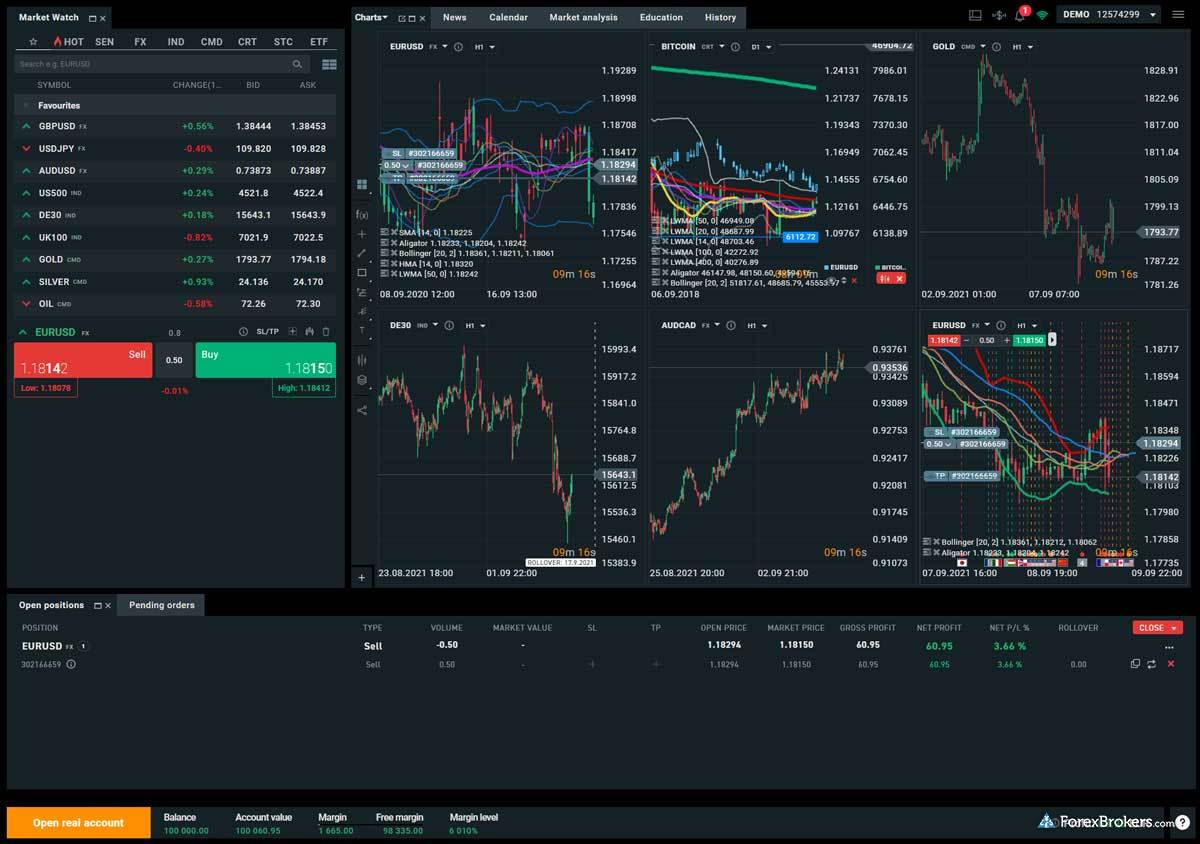

XTB offers MT4 in select locations, but its feature-rich xStation 5 platform steals the show with its minimalist design and powerful tools.

Platforms overview: XTB offers two flagship web-based trading platforms: xStation 5, and – from select locations – the MetaTrader 4 (MT4) platform developed by MetaQuotes Software Corp (not available from Cyprus, France, or the U.K.).

Charting: Beyond its responsive modern design (and its 30 drawing tools and 39 technical indicators), there are several unique features that help xStation 5 stand out. For example, I loved the fact that charts include a countdown timer showing the remaining time left in each candlestick. Also, economic news releases appear along the bottom axis of its charts, providing traders with helpful insights during important economic events.

xStation 5 trading tools: XTB’s flagship platform offering, xStation 5, delivers an excellent experience for web, mobile, tablet, and even iOS and Android smartwatches. Trading tool highlights include color-coded heat mapping for analyzing top movers, a versatile stock screener, and sentiment data that shows the percentage of XTB clients that are long or short for a given trading symbol.

| Feature |  |

| Virtual Trading (Demo) | Yes |

| Proprietary Platform | Yes |

| Desktop Platform (Windows) | Yes |

| Web Platform | Yes |

| Social Trading / Copy Trading | Yes |

| MetaTrader 4 (MT4) | Yes |

| MetaTrader 5 (MT5) | No |

| DupliTrade | No |

| ZuluTrade | No |

| Charting – Indicators / Studies (Total) | 39 |

| Charting – Drawing Tools (Total) | 30 |

| Charting – Trade From Chart | Yes |

| Watchlists – Total Fields | 8 |

Market research

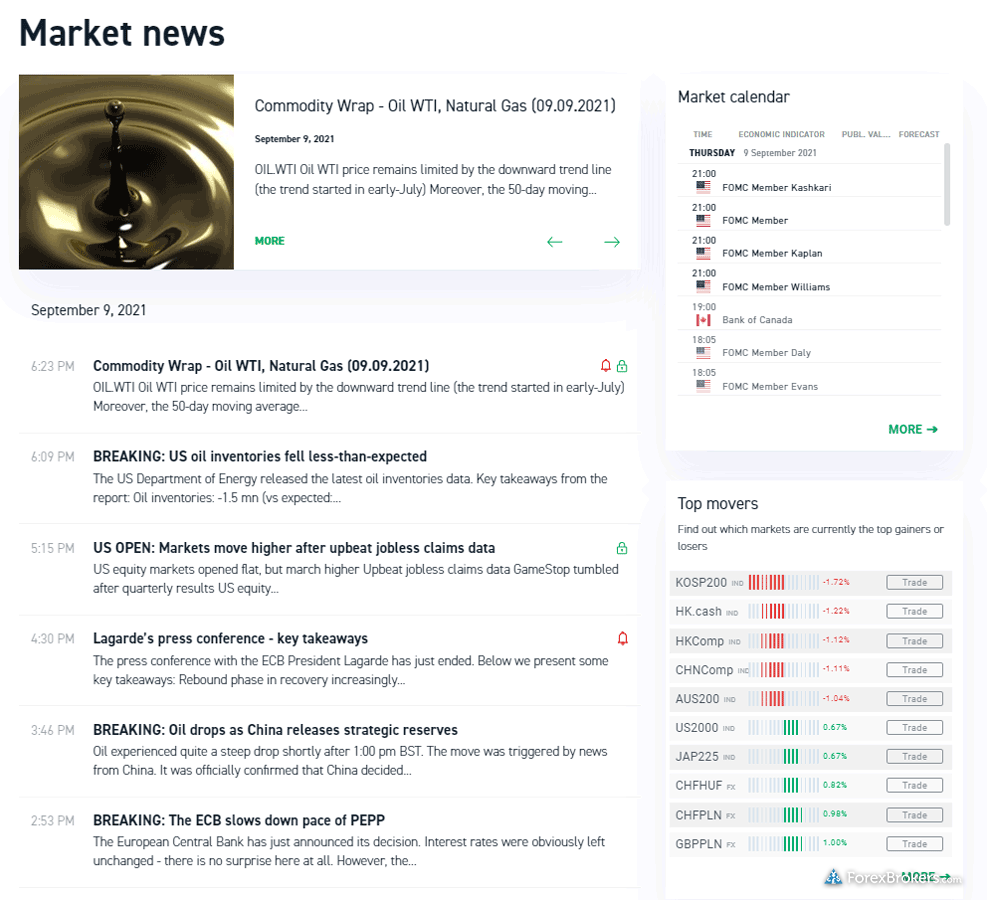

XTB’s research content can compete with the best in the industry, thanks to high-quality analysis from in-house staff as well as third-party providers. That said, XTB does not publish as many daily English articles and videos as some of the best brokers in this category – though it does have a strong international presence in other languages.

Research overview: XTB makes up for the absence of Trading Central and Authochartist by offering exclusive strategies as part of its Premium Research service. In addition to streaming headlines from top-tier news providers, XTB offers an economic calendar, market sentiment, and other platform tools for research. XTB also provides written articles from its staff and weekly video webinars on YouTube, including in other supported languages, such as Polish, German and Italian.

Market news and analysis: XTB publishes quality articles on its Market News section which are then streamed as headlines within the xStation 5 platform. The research includes both fundamental and technical analysis, with features such as its “Chart of the day” series. Trading signals are also included within XTB’s news panel, with price analyses from Thomson Reuters, Barclays, Citi Group, and other top-tier providers.

News filtering: Identifying articles written by in-house staff (versus third-party content) is not a seamless experience at XTB. Saxo Bank’s web platform, for example, allows for the ability to filter news content by source (in-house vs third-party). As a trader, I appreciate what XTB’s staff has to say, so the ability to filter or easily identify in-house content would be a welcome enhancement.

| Feature |  |

| Daily Market Commentary | Yes |

| Forex News (Top-Tier Sources) | Yes |

| Autochartist | No |

| Trading Central (Recognia) | No |

| Social Sentiment – Currency Pairs | Yes |

Education

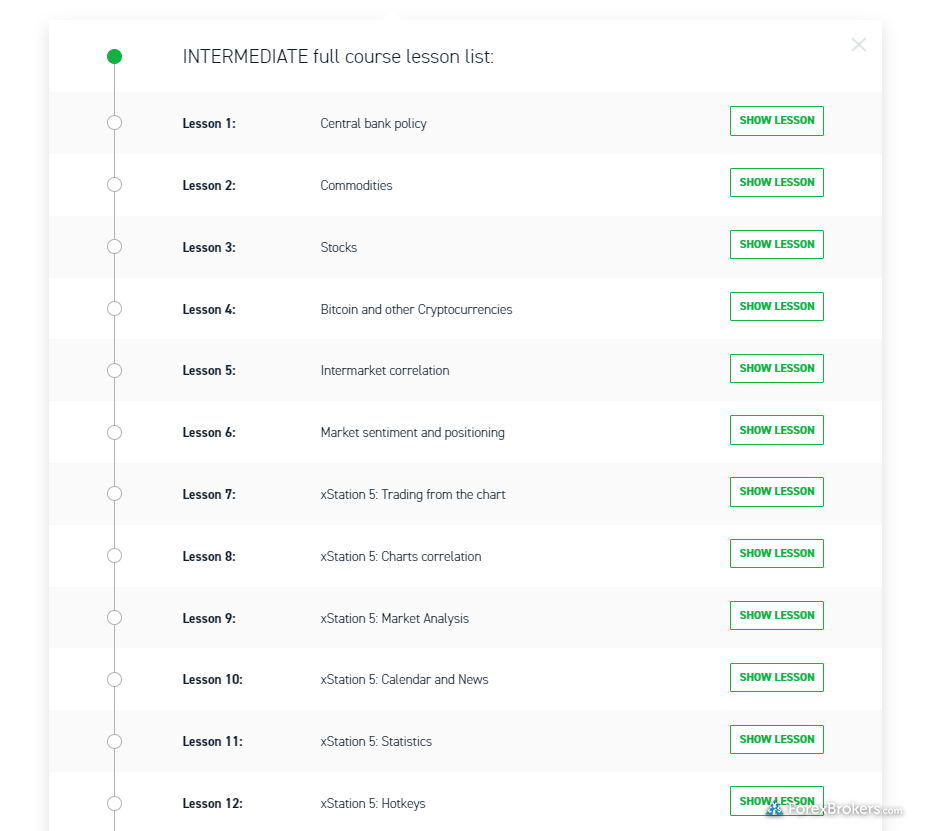

I was impressed with XTB’s educational offering, thanks to its extensive written content, video materials, and archived webinars. XTB generally does a great job incorporating education throughout its platform suite and website. The only drawback is the lack of organization of its video content– it doesn’t all live in one place, and is instead scattered throughout its platform and its YouTube channel.

Learning center: XTB provides a variety of materials on its website under the “Learn To Trade” section, all of which can be sorted by topic or experience level. More than 200 lessons available in XTB’s well-organized Trading Academy, along with enhanced FAQs, platform tutorials, financial market education, premium content for live account holders.

There are at least ten lessons that cover forex and CFD education, and each category features quizzes. There are also dozens of articles covering broader subjects like “What are macroeconomic indicators?”

Room for improvement: XTB provides a good balance of videos within its Trading Academy and on its YouTube channel, including 17 videos in its Masterclass series. Many of these videos are also integrated in the Premium section within the xStation 5 web platform and mobile app. Organizing all these videos by category or experience level, and keeping them in one place – such as within the Trading Academy or a dedicated video library – would be a great way to arrange for seamless access to all of XTB’s video content. In addition, I liked that progress tracking is incorporated, giving traders the option to measure their learning progress – though quizzes or tests would be a welcome addition.

| Feature |  |

| Has Education – Forex or CFDs | Yes |

| Client Webinars | Yes |

| Client Webinars (Archived) | Yes |

| Videos – Beginner Trading Videos | Yes |

| Videos – Advanced Trading Videos | Yes |

| Investor Dictionary (Glossary) | No |

Final thoughts

XTB is a trusted brand that provides a broad selection of tradeable securities, outstanding customer service, competitive research, and its innovative xStation 5 proprietary trading platform suite.

Though pricing is just average, XTB finished Best in Class for 2022 in our Research, Education and Overall categories, out of 39 brokers. XTB left me impressed, and is worth close consideration from traders seeking a broker for trading forex and CFDs in 2022.

About XTB

XTB was founded in Poland in 2002 and has since grown to become a well-known broker for trading forex and CFDs. With a market capitalization of $409 million as of September 21, 2021, XTB is publicly traded on the Warsaw Stock Exchange (WSE: XTB.PL). Serves 105,005 active clients globally as of its 2021 H1 report for the first of the year. XTB maintains offices in over a dozen countries across Europe and is licensed by numerous regulators, including the U.K.’s FCA, Poland’s KNF, Germany’s BaFIN, Spain’s CNMV, France’s AMF, Cyprus’ CySEC, the U.A.E’s DFSA, South Africa’s FSCA, and Belize’s FSC. XTB holds indemnity insurance of up to $1M per client claim and up to $5M total through its Belize entity.

2022 Review Methodology

For our 2022 Forex Broker Review we assessed, rated, and ranked 39 international forex brokers over a three-month time period resulting in over 50,000 words of published research.

Each broker was graded on 113 different variables, including our proprietary Trust Score algorithm. This innovative scoring system ranks the level of trustworthiness for each broker based on factors such as licenses, regulation and corporate structure. Read about Trust Score here.

As part of our annual review process, all brokers had the opportunity to provide updates and key milestones and complete an in-depth data profile, which we hand-checked for accuracy.

Ultimately, our rigorous data validation process yields an error rate of less than .1% each year, providing site visitors with quality data they can trust. Learn more about how we test.

Forex Risk Disclaimer

There is a very high degree of risk involved in trading securities. With respect to margin-based foreign exchange trading, off-exchange derivatives, and cryptocurrencies, there is considerable exposure to risk, including but not limited to, leverage, creditworthiness, limited regulatory protection and market volatility that may substantially affect the price, or liquidity of a currency or related instrument. It should not be assumed that the methods, techniques, or indicators presented in these products will be profitable, or that they will not result in losses. Read more on forex trading risks.

Reviews

There are no reviews yet.